Contributing to today's rental squeeze is a lack of supply, not just because we're not building enough homes, but also because more landlords than usual are selling their real estate investments in 2023.

This is a problem because the number of landlords in Australia is already quite small, and they are charged with supplying the bulk of private rental accommodation in this country.

There were only 2.25 million landlords in Australia in FY21, according to the latest Australian Tax Office data. That's not a lot in a country of 26.5 million people, where 30% of households are renters.

So, a higher number of landlords selling this year, coupled with fewer people buying real estate investments over a five-year period prior to the pandemic, is a cause for concern. Especially when CoreLogic estimates there is currently a shortfall of close to 50,000 rental homes nationwide.

More landlords selling their real estate investments in 2023

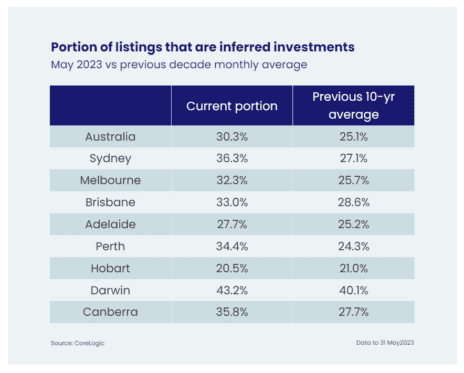

CoreLogic picked up on this trend earlier in the year, noting that all capital cities except Hobart had a higher portion of investment listings than the historical 10-year average in the month of May.

The problem is that real estate investment homes are more likely to be purchased by owner-occupiers, thereby reducing the rental supply at a time when metro and regional vacancy rates are at record lows.

Eliza Owen, CoreLogic's Head of Residential Research Australia, said:

Historically, purchasing data shows the majority of buyers are owner-occupiers. And it's entirely possible the increase in investment listings may lead to owner occupiers purchasing homes that were previously investment properties.

Investment purchases fell dramatically in 2015-2020

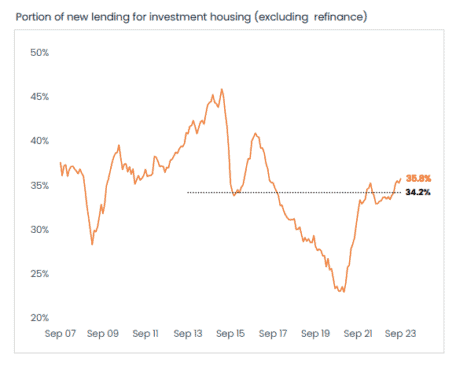

The current trend of investors selling their assets comes on top of a five-year period between 2015 and 2020 when investor purchasing activity in Australia experienced a significant decline, as shown below.

Source: CoreLogic

The decline began a few months after the Australian Prudential Regulation Authority (APRA) asked the banks to reduce the number of new investor loans issued to ensure stability in the banking system. APRA also asked them to limit the number of interest-only loans issued, which investors prefer for their real estate investments.

The banks responded by raising interest rates on investor loans, and even though APRA withdrew its advice in 2018, those interest rate premiums for investors still exist today.

Difficulty securing enough finance to fund a real estate investment purchase, coupled with higher interest rates on loans, may be among the reasons why investors shied away from property in 2015-2020.

Why are investors selling today?

Owen discussed some of the reasons that may be driving investors to sell today, commenting:

The first driver might be higher interest costs over the course of the year. While rents have risen at a record pace over the past few years, they generally have not risen as much as mortgage costs on a new loan. If the interest burden is becoming too high amid an already high inflationary environment, investors may be looking to offload their investment.

Another key driver might be capital growth. If you look at a city like Perth, where the portion of investment sales surged in mid-2020 and remained high ever since, this may reflect investors finally getting some pay-off after a long period of decline in home values for much of the 2010s.

REA Group Ltd (ASX: REA) economist Anne Flaherty also points out the ageing demographics of Australian landlords.

She says more than half of all Australian property investors are aged over 50. It's reasonable to assume that as people get older, they may cash in their real estate investments for their retirement.

Whatever the reasons, we are seeing the impact of landlords leaving the market today, with rents rising for 10 consecutive quarters. That's the longest continuous period of rent rises in history, according to Domain data.

What else are landlords dealing with?

Besides higher interest rates, there's the impact of high inflation on holding costs such as insurance premiums, strata levies, repairs, and property management fees.

Then there are higher land taxes, enhanced tenants' rights, and increased government intervention in the private rental sector. This includes nightly caps and new taxes on short-stay accommodation, limits on how often rents can be raised, and the Queensland Government's attempt last year to charge land tax based on an investor's Australia-wide real estate investments, not just their properties in Queensland.

And we've recently seen the Federal Greens pushing for a rental freeze, which would have denied mum-and-dad investors the ability to amplify their returns on investment (ROI) in a rising market.

Property Investment Professionals of Australia (PIPA) chair Nicola McDougall said investors were fed up with the government restricting what they could do with their real estate investments.

McDougall said:

PIPA has been warning for nearly a decade about the negative impacts of market intervention on rental markets, starting with the APRA lending restrictions that came into effect in 2015, and now a variety of rent caps or controls.

The ATO stats don't lie, investors have already deserted markets around the nation – and especially in Victoria and Queensland – because they no longer have control of their assets.

Are landlords thinking, 'this is getting too hard'?

Could landlords today be feeling a little 'over it'? Especially when there are arguably simpler investment vehicles available that also produce attractive returns, such as ASX shares, bonds and even cash?

We don't see governments telling investors in these asset classes what they can do with their investments, and this is not lost on the average Australian landlord right now.

The REA Property Seeker Survey, conducted in May this year, found 50% of landlords believe that investing in property is not as attractive as it used to be.

Additionally, 32% said the returns from real estate investment were not worth the effort.

Will investors switch from real estate investment to ASX shares?

In this increasingly challenging backdrop for real estate investment, will landlords take their money out of property and put it into ASX shares? Or even simple savings accounts paying 5.5%-plus?

Flaherty says:

All of these factors are prompting more investors to sell up, and over the past five years the share of investors selling has been higher than the share buying — a trend that has accelerated post-COVID.

Given the current shortage of rental properties, the fact we are likely to see more older investors sell up as they enter retirement is cause for concern, particularly in light of the rapid population growth Australia is now experiencing.

Flaherty points out that older Australians are typically more concerned with yield to fund their living costs.

In a recent article, we discovered that today's booming rents may not be enough to deliver superior passive income to ASX dividend shares once the holding costs of property are factored in.

Does property investment deliver superior capital growth compared to ASX shares? We also took a look at that in a recent article.

Maybe it's easier to invest in property via ASX property shares? Check out our analysis here.