ASX mining stock Cobre Ltd (ASX: CBE) more than doubled its market valuation in less than 30 minutes this morning after the company released an announcement.

The Cobre share price is up by 112.2% to 8.7 cents per share at the time of writing. The ASX mining stock closed at 4.1 cents yesterday.

Meantime, the S&P/ASX All Ordinaries Index (ASX: XAO) is up 0.6%.

What's the big news for this ASX mining stock?

The junior copper exploration company has been selected by BHP Group Ltd (ASX: BHP) to participate in the mining giant's 2024 Xplor program.

BHP created the Xplor program to help young companies in the critical minerals space accelerate their operations and potentially establish a long-term partnership with the mining giant.

Xplor runs for six months, during which time BHP will give Cobre US$500,000 in non-dilutive funding, as well as access to its internal expertise and global network of suppliers, to advance its exploration activities.

Cobre will use the money to accelerate its Kitlanya West Project in Botswana.

The ASX mineral explorer controls approximately 5,348 square kilometres of tenements within the Kalahari Copper Belt (KCB). The KCB is one of the world's most prospective areas for copper.

At the conclusion of the Xplor program period, Cobre is under no obligation to partner with BHP.

What did management say?

Cobre said the funds would be spent progressing targets that the company thinks may host tier-one copper-silver deposits.

It looks like BHP has confidence in Kitlanya West. Cobre announced "encouraging new targets" at the site in November. Drilling results led to an increased estimate of the target size to 4 km x 1.2 km.

Part of the Xplor deal is the option for BHP to retain certain pre-emption rights at Kitlanya West for 12 months after the program ends.

Cobre CEO Adam Wooldridge said:

The Xplor program provides us with a unique opportunity to partner with BHP experts to further our Kalahari Copper Belt targeting criteria and exploration programs.

We're delighted to have successfully made it through the rigorous selection process, which is a great accolade for the technical merits of our team and exploration projects.

We're looking forward to participating in the program and developing priority targets where the Xplor funding will provide further value for our shareholders.

What else is Cobre working on?

Cobre is also working on its Perrinvale project in the Panhandle Greenstone Belt of Western Australia.

It has discovered a globally rare VHMS deposit enriched in high-grade copper, gold, silver, and zinc.

Sandfire Resources Ltd (ASX: SFR) discovered Australia's last significant VHMS deposit more than a decade ago.

Share price snapshot for this ASX mining stock

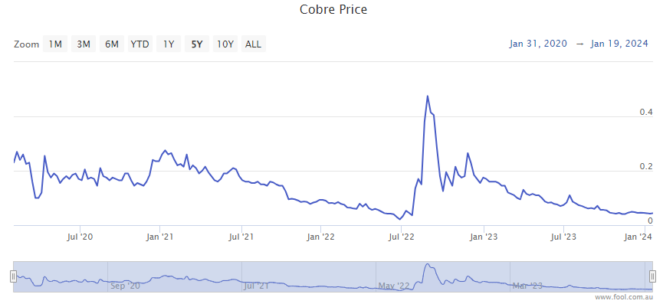

The ASX mining stock was listed on the ASX in early 2020 at 20 cents per share.

Here is its history: