When an S&P/ASX 200 Index (ASX: XJO) stock has fallen or risen strongly, it is difficult to figure out whether it is a great time to buy.

That's because, psychologically, investors are likely to think that they have missed out on most of the profits of a stock that has already rocketed.

Conversely, shares that have fallen are also intimidating because punters are fearful that there are more losses coming.

So what do you do?

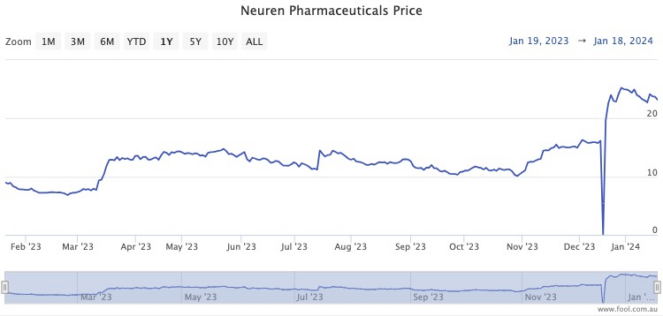

One of the hottest ASX 200 stocks in recent times has been Neuren Pharmaceuticals Ltd (ASX: NEU).

The Neuren share price has soared an unbelievable 163% over the past 12 months.

Let's break down whether one should buy this ASX 200 stock, or avoid it like the plague:

Professional investors aren't too worried

Firstly, it's worth noting that all five analysts surveyed on CMC Invest reckon Neuren is still a buy despite the massive run-up in price.

So they obviously think Neuren has plenty more upside to come.

The analysts at Elvest Fund, who are in this camp, thought last month's phase 2 clinical test results for NNZ-2591 "exceeded expectations" in its ability to combat Phelan-McDermid syndrome (PMS).

"The PMS results bode well for the Phase 2 trials of NNZ-2591 for Pitt Hopkins syndrome, Angelman syndrome and Prader-Willi syndrome, results of which will be released during CY24."

The team thought the results were even more convincing than the effectiveness of Daybue, which is a drug that Neuren already has on sale commercially.

"In the meantime, we expect to see continued strong sales growth for Daybue, which is licensed to NASDAQ-listed Acadia Pharmaceuticals Inc (NASDAQ: ACAD), who will next report in early February."

ASX 200 shares have no memory

Just this example shows that what has happened to the share price in the past has no bearing on what the future might hold.

When investors are fearful because of a steep increase or decrease in price in recent times, that is called "anchoring". And anchoring prevents rational decision-making.

The critical fact to remember is that stocks themselves have no memory. Their future direction has zero relationship to where they have been in the past.

Therefore there is no "right" or "wrong" time to buy a specific ASX 200 stock.

If the business is going places and the metrics meet your investment criteria, then it's ripe for adding to the portfolio as a long-term holding.