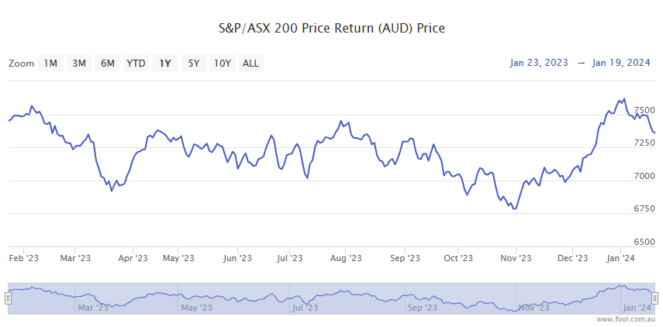

S&P/ASX 200 Index (ASX: XJO) shares are enjoying a good run on Monday, up 0.6% in afternoon trade.

The benchmark index is enjoying some tailwinds blowing from the United States after the S&P 500 (INDEXSP: .INX) closed up 1.2% on Friday to set a new record high.

And today's advance comes atop the 1.0% gains posted by the ASX 200 on Friday.

US and Aussie stock markets have moved higher over the past two trading days despite slumping expectations that the Federal Open Market Committee (FOMC) will begin cutting interest rates at its next meeting in March.

As of Friday, consensus expectations for a March Fed interest rate cut had fallen below 50%.

Despite minutes from the central bank's December policy meeting revealing that FOMC members think the improving outlook for inflation in the US will usher in lower rates, they also noted that the first rate cuts might not occur until "the end of 2024".

Higher rates for longer would not only pressure US stocks, but also many ASX 200 shares vulnerable to elevated interest rate levels in the US.

In potentially good news to investors, however, Goldman Sachs believes the world's most watched central bank is indeed likely to begin easing in March.

ASX 200 shares could get a March boost from the Fed

According to the analysts at Goldman Sachs (courtesy of The Australian Financial Review), "Despite a modest bump in December, inflation news remains very favourable, with global core inflation averaging just 2.0% annualised over the last three months."

The broker is forecasting that core inflation figures will average an annualised 1.9% for the second half of 2023, ushering in rate cuts that should help support ASX 200 shares in 2024.

Goldman stated:

With the labour market and inflation expectations also back in balance, we expect the Fed to start cutting the funds rate soon, probably in March. We expect consecutive 25 basis point [0.25%] cuts in March, May, and June, followed by quarterly cuts from Q3 onwards (for a total of five cuts in 2024).

And with the US Fed having led other central banks in the charge towards higher rates, Goldman now expects those banks will follow the Fed's lead lower.

"We expect both the European Central Bank and the Bank of England to closely follow with per-meeting cuts beginning in Q2, and to cut by 150bp each this year," the broker said.

"Our expectation of significant cuts combined with resilient activity and falling inflation supports our above-consensus growth views in most major economies," Goldman added.

The broker did not make any forecast for the RBA. But falling interest rates in the US and across Europe may at least keep Australia's central bank for pushing through with another rate hike on 6 February.

Which would certainly be welcome news for investors in ASX 200 shares.