The S&P 500 (INDEXSP: .INX) closed up 1.2% on Friday, notching a new all-time high for the first time in almost two years.

In Aussie markets today, the S&P/ASX 200 Index (ASX: XJO) looks to be catching some tailwinds from that record, which saw the S&P 500 end the day at a never-before-seen 4,839.81 closing level.

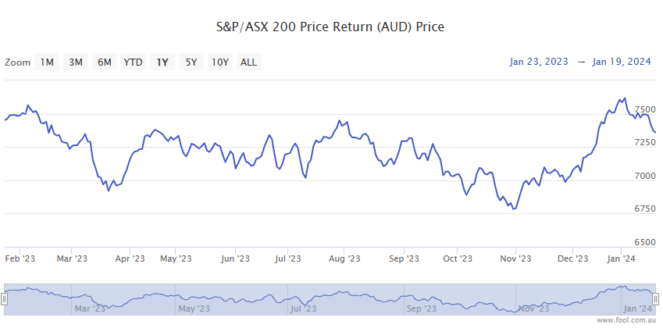

During the Monday lunch hour, the ASX 200 is up 0.8%. This comes after gaining 1.0% on Friday. That sees the ASX 200 at 7,478.70 points, leaving it within striking distance (2.1%) of the record 7,6328.9 points set on 13 August 2021.

The past few days of gains have followed a profitable 2023 for index investors.

The S&P 500 gained an impressive 24.7% in 2023, while the ASX 200 closed the year up 9.3%. If we add dividends back in, that's closer to a 13.9% gain for the Aussie benchmark index.

S&P 500 at new all-time highs. Now what?

With the S&P 500 trading at new record highs, what can ASX 200 investors expect from the US stock markets next?

According to Comerica Wealth Management strategist John Lynch, the US benchmark index could continue to gain significantly from here in 2024.

"Liquidity is a powerful force," Lynch said (quoted by The Australian Financial Review).

Lynch added:

We look for the combination of expanded liquidity, 8.0% earnings growth, and declining inflation-adjusted or 'real' interest rates to support higher market multiples as the year progresses.

As for the year ahead, he said, "We continue to believe the S&P 500 would be fairly valued in the 5,200 range by year-end." That's some 7.5% above Friday's record close.

Rob Swanke, senior equity strategist for Commonwealth Financial Network, also remains upbeat on the 2024 outlook for the S&P 500, which should help boost the ASX 200.

"At the time of the last market peak at the beginning of 2022, we saw valuations at 21.4x forward earnings projections, so there's still room to move higher from the 19.6x were seeing today," Swanke said.

He noted this was especially true "given the potential for AI to fuel greater growth and productivity in the economy".