APM Human Services International Ltd (ASX: APM) shares are rebounding today but only slightly — up 2.8% to 81 cents. Meantime, the S&P/ASX 200 Index (ASX: XJO) is up 0.9%.

The international employment services company was thrashed by the market yesterday after releasing its 1H FY24 update after the market close on Wednesday.

APM reported preliminary unaudited revenue of $1.14 billion for the six months ended 31 December, up from $853.7 million in 1H FY23.

However, its underlying NPATA plummetted 35% from $85.4 million in 1H FY23 to $55 million in 1H FY24.

Investors delivered a walloping to APM shares yesterday, with the share price falling 40%.

APM shares spiralled to an all-time low of 79 cents and a closing value of 80 cents.

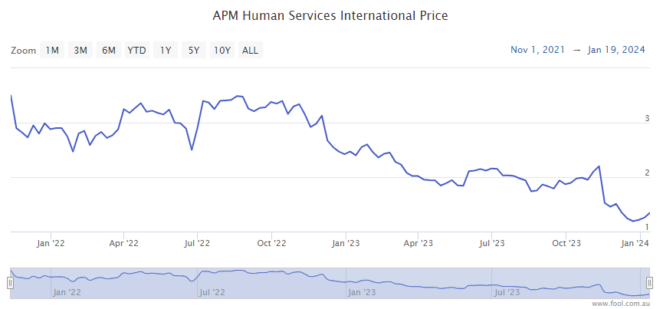

This is a stunning turn of events for the company, which was only listed a little over two years ago at $3.55 per share. The chart below documents the decline of the APM share price.

The company said the weak first-half performance was due to continuing low unemployment.

This meant reduced client flows into employment services programs and fewer job placements, especially in Australia and the United Kingdom. It also cited higher interest rates and taxes.

APM expects things to improve in 2H FY24, noting that a second-half skew is consistent with prior reporting periods.

APM's update comes amid the sixth consecutive quarterly fall in job vacancies in Australia.

The unemployment rate is also steadying at 3.9% for both November and December.

David Taylor, head of labour statistics at the Australian Bureau of Statistics (ABS), said:

In trend terms, many of the key indicators still point to a tight labour market.

However, the increasing unemployment rate since November 2022, along with the rising underemployment rate and slowdown in the growth of employment and hours worked, suggest that the labour market is starting to slow.