The harsh reality is that no one, even the most seasoned professional fund managers, know what will happen with stocks.

One classic example is James Hardie Industries plc (ASX: JHX), which is QVG Long-Short Fund's second largest holding.

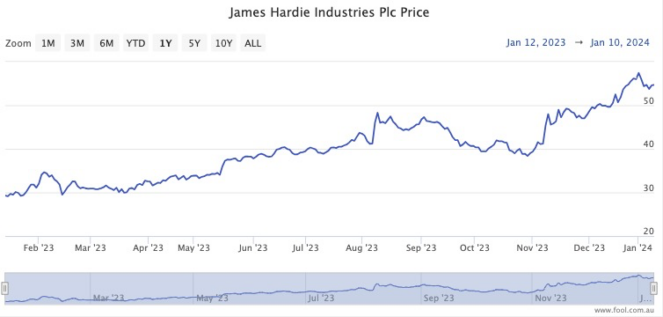

The share price for construction materials maker has now rocketed more than 111% since Christmas Eve 2022.

Although the QVG analysts obviously bought the S&P/ASX 200 Index (ASX: XJO) shares thinking they would rise, even they were surprised at how the stock has performed.

"Building materials company James Hardie rose 16% in December taking its annual return to over 100%," read a memo to QVG clients.

"We could not have foreseen James Hardie doubling in a year when the 30-year fixed rate mortgage in the US touched a decade-high 7.8%."

'Conviction in the competitive advantages'

With still a substantial holding, the QVG team is still bullish on James Hardie despite the steep run-up in share price.

The conditions are just right for the company both internally and externally.

"James Hardie benefited from improved sentiment towards housing activity in its important US market," read the memo.

"Conviction in the competitive advantages of their product allowing it to be a long-term market share gainer helped us to hold the stock in the face of obvious macroeconomic headwinds."

The QVG analysts are not the only fans of James Hardie.

The CMC Invest broking platform currently shows 10 out of 14 analysts rate the ASX 200 stock as a buy.

Eight of those think it's a strong buy, despite the share price continuing to break 52-week highs.

The Motley Fool's Mitchell Lawler earlier this month pointed out that, within the ASX 200, James Hardie was one of the big winners of 2023 that did not show "stomach-churning volatility".

"The obvious perk of reduced volatility is less time feeling like your heart is in your throat.

"Investing can induce emotionally charged decisions in even the most experienced partakers… If a company's share price tends to move slowly, it could mean a better night's sleep and a more rational approach."