Ironically, ASX healthcare shares have had a rough time since COVID-19 struck the world.

The S&P/ASX 200 Health Care Index (ASX: XHJ) went sideways from 2020 to the end of 2021, then it dived more than 20% in 2022 as inflation and interest rate fears struck the market.

To add to that, between June and October last year the sector sank a painful 21.5%, despite many experts tipping that it would roar back.

So healthcare supporters have been burnt badly multiple times the last few years.

But that also means contrarian investors are buying up some of the bargains out there with a long overdue 2024 rally in mind.

Here are three ASX healthcare shares that could put some smiles on investor faces in the coming years:

Paying its own way

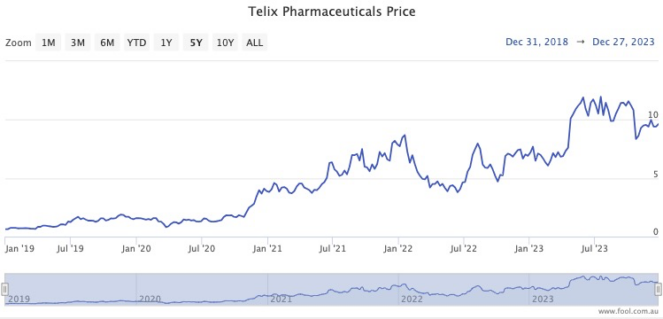

Despite the sector malaise, Telix Pharmaceuticals Ltd (ASX: TLX) shares have held up pretty well through all 13 interest rate hikes.

From a trough on 13 May 2022, the share price has gained a spectacular 165%.

That's all thanks to the company achieving its first commercial release that year with a prostate cancer imaging product called Illucix.

That brought the startup from its pre-revenue phase to one that made its own money for its future product pipeline.

The Telix share price dipped somewhat in the final quarter of 2023, with it now trading about 12% lower.

Perhaps that's why it has plenty of fans in the professional community, with all seven analysts surveyed on CMC Invest rating it as a buy.

'Valuation looks cheap'

Clarity Pharmaceuticals Ltd (ASX: CU6) has also gone gangbusters while its sector mates have suffered.

The stock price pretty much doubled over 2023.

Frazis Capital portfolio manager Michael Frazis is an admirer of the biotech.

"This is the most exciting company I've come across in Australia lately."

Coincidentally, Clarity is also involved with the treatment of prostate cancer, and Frazis reckons there's still plenty more upside.

"In a space where companies with promising data are being acquired for billions of dollars, and Clarity's early indications look best-in-class, the company's post-runup US$340 million valuation looks cheap."

According to CMC Invest, both Jefferies and Wilsons analysts rate Clarity as a strong buy.

10 experts reckon these healthcare shares are a buy

Avita Medical Inc (ASX: AVH) shares took an absolute hammering after the COVID-19 pandemic hit, losing more than 90% of its value at one stage.

But 2023 was a triumph, soaring more than 120%.

The company is on the up, with all 10 analysts currently surveyed on CMC Invest recommending it as a buy.

Morgans healthcare and life sciences analyst Scott Power told NT News last week that Avita Medical in February will report its full year results and outlook guidance.

"We expect both will be well received by the market and we should sales grow almost 40%."

Power explained how in May the US FDA is expected to approve Avita's marketing application for its Recell Go product.