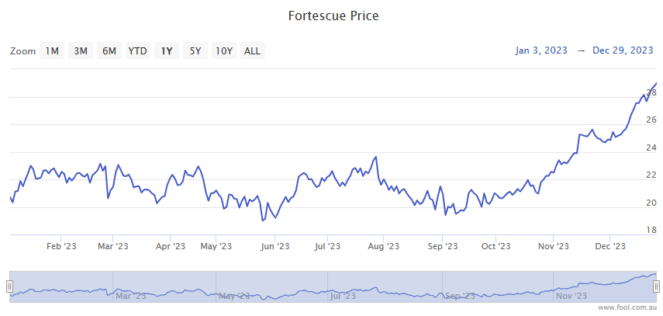

The Fortescue Metals Group Ltd (ASX: FMG) share price kicked off 2024 with a bang, closing on Tuesday setting a new all-time high.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining stock closed up 1.3% yesterday, trading for $29.39 apiece.

That put shares up 44% over 12 months and a whopping 576% over five years. And that's not including dividends.

Investors have been bidding up the Fortescue share price over the past few months amid a resurgent iron ore price, spurred in part by hopes of a pending rebound in the sluggish Chinese property markets.

Indeed, iron ore gained another 2% overnight, trading for just under US$142 per tonne. It was only back in mid-August the industrial metal was trading for US$103 per tonne.

But the latest boost in the iron ore price hasn't been enough to keep the Fortescue share price from slipping from its record highs today, with shares down 1.3% in afternoon trade at $29.02 apiece.

This comes amid news that a number of the miner's iron ore railcars ran off the tracks in Western Australia's Pilbara region.

Fortescue share price retreats from record highs

As ABC News reports, the derailment occurred on Saturday, roughly 150 kilometres south of Port Hedland.

Fortescue's rail operations into the Port Hedland iron ore export hub remained suspended throughout the day on Tuesday, but were expected to resume today.

A spokesperson for the miner said that nobody was injured in the derailment but provided few other details.

Fortescue said the four-day rail shutdown would not impact its December iron ore shipments. The potential impact for January shipments remains to be seen, with Fortescue not yet responding to media inquiries.

Any significant reduction in shipments could throw up some headwinds for the Fortescue share price.

Though it should be noted that ASX 200 investor reaction to news of the derailment remains muted.

The ASX 200 is also down 1.0% today.

And today's 1.3% fall in the Fortescue share price is broadly in line with the 1.2% retrace in the BHP Group Ltd (ASX: BHP) share price, with Rio Tinto Ltd (ASX: RIO) shares also down 1.2% at the time of writing.