Fortescue Ltd (ASX: FMG) shares and Australia's two other ASX mining giants are all generous dividend payers, delivering juicy passive income to investors for many years, and that is set to continue in FY24.

Market analysts currently expect Fortescue shares to pay a 6.14% dividend yield in FY24. This compares to an anticipated 5.45% yield from Rio Tinto Ltd (ASX: RIO) and 4.39% from BHP Group Ltd (ASX: BHP).

But has Fortescue always paid the highest yield?

Let's investigate the history of dividend yields delivered by our three biggest ASX 200 mining shares.

History of big ASX mining dividend yields

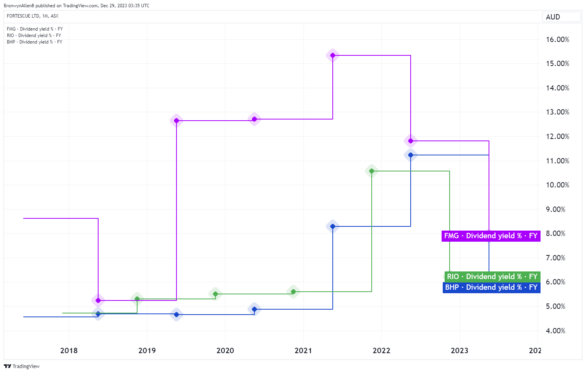

Here is a five-year chart showing how Fortescue shares compare to BHP and Rio Tinto on annual dividend yields.

The yields are plotted on a 12-month trailing basis, expressed as a percentage of the share prices at the time.

As you can see, Fortescue shares have been the dominant payer since 2018.

Forecast dividend yields recently raised

A stronger iron ore price has boosted the outlook for FY24 dividends from the big three miners in recent weeks.

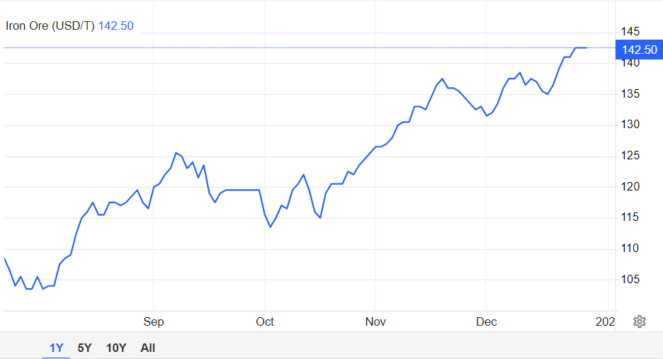

The iron ore price has surged by 6.74% over the past month. It finished the trading year at US$142.50 per tonne. That's the highest level the commodity has traded at for 18 months.

The strengthened commodity price is due to economic support measures implemented in China.

Amid disinflation and a weakening local property sector, the Chinese Government is seeking to stimulate infrastructure development and manufacturing in the new year, according to Trading Economics analysis.

That will be a handy offset to continuing weaker demand for property. There has been lower construction activity and defaults among major Chinese property developers in 2023.

China removed the annual steel production cap in August, which lifted demand for key iron ore inputs.

As the chart below shows, that's about the time that the iron ore price began its late-year run.

Source: Trading Economics

Why do Fortescue shares pay more?

It's worth noting that both BHP and Rio Tinto mine other metals and minerals.

Meantime, Fortescue is still an iron ore pure-play.

China's insatiable demand for iron ore over the past five years is likely one factor in Fortescue's history of paying stronger dividend yields than the other major ASX 200 mining shares.