Becoming a millionaire after starting with just $10,000 seems unlikely, but it's entirely possible with the combined power of stocks and compounding.

Of course, your portfolio should be well diversified in order to reduce the risk of disaster.

But taking a look at one specific example can demonstrate how reaching $1 million is within the grasp of the ordinary punter.

Let's break it down:

Check out this ASX 200 beauty

As a member of the S&P/ASX 200 Index (ASX: XJO), Neuren Pharmaceuticals Ltd (ASX: NEU) is no small cap.

The $2.9 billion biotech outfit develops treatments for rare neurological conditions.

While it has a batch of products under testing and pending approval, it already has the world's only treatment for Rett Syndrome, Daybue, in the commercial market.

Daybue is licensed to the $7 billion US company Acadia Pharmaceuticals Inc (NASDAQ: ACAD).

Neuren Pharmaceuticals receives royalty payments from this agreement, providing it revenue to work on its future pipeline.

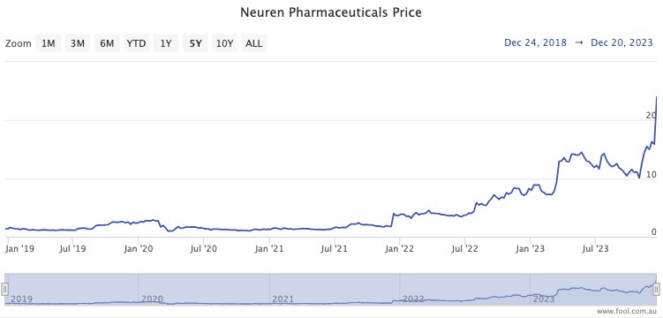

With revenue pouring in and favourable clinical trial results coming through, the Neuren share price has performed incredibly in recent times.

Just this month, the stock has rocketed 55%, to add to a 45% rise in November.

If you go back to the start of the year, Neuren shares have almost tripled.

For longer-term investors, the five-year return is a phenomenal 1,593%.

That means that $10,000 of Neuren shares purchased a half-decade ago would now be worth around $160,000.

Where is my million?

Nice work already. But what about the million, you ask?

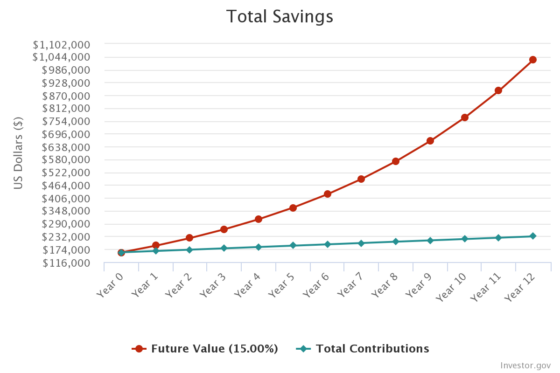

The chances are even Neuren Pharmaceuticals could not keep up the breakneck pace of 74% compound annual growth rate (CAGR).

Let's assume as the business matures, the CAGR settles down to a more modest 15%.

If you can keep adding $500 each month to the $160,000 parcel, your Neuren shares will have grown to a million bucks after 12 years.

Past performance is never an indicator of the future, but this example shows how $10,000 can turn into seven figures using ASX 200 shares.

Good luck with your investments.