Iron ore companies are a major part of the ASX and the Australian economy, so it's always noteworthy to see where their fortunes lay, even if you have no direct holdings.

Of course, the share prices of those businesses are heavily dependent on the global price for the commodity.

With Western countries all jacking up interest rates to douse high inflation and China performing CPR on its economy to fight deflation, the iron ore price tumbled below the US$100 mark in May.

However, it has steadily climbed since then to now hover around the $135 level.

Fairmont Equities managing director Michael Gable recently had a crack at predicting where iron ore and iron ore shares may head next year.

'They are still sceptical'

Firstly, Gable points out that the market is still in some shock over the 35% rise in the commodity price over the last seven months.

"The price of iron ore has surprised all the analysts this year," Gable said on the Fairmont blog.

"We have noticed that they have started to slowly move up their very low price targets on the iron ore miners, but they are still sceptical."

Once the analysts and institutional investors become believers, that's what will trigger "the big miners to head higher", he added.

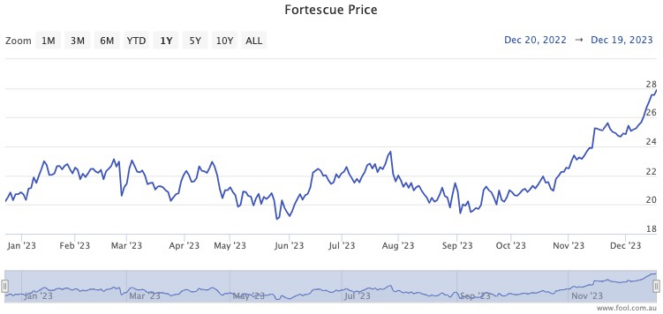

"We have been bullish on Fortescue Ltd (ASX: FMG) shares all year, noting that a break above $23 will lead to levels in the high $20s.

"That is now happening, but all the other analysts are still slow to react."

The Fortescue share price has rocketed more than 40% since early September.

Iron ore shares could break out next year

For Gable, it's just a matter of time before the market finally believes the supply-demand imbalance for iron ore.

"Recent comments by the Vale SA (BVMF: VALE3) CEO indicate that the market will be very tight for a while yet," he said.

"Chinese PMIs have looked weak, but they clearly are numbers that need to be taken with a pinch of salt — or to put it a bit more honestly, the numbers can't be trusted."

The economic stimulus the Chinese Communist Party has injected is "clearly working behind the scenes".

"How else do you account for a 16% spike in the iron ore price in the past 6 weeks?

"It will only be a matter of time until the market realises that China is recovering."

His team expected the iron ore bull run to occur even earlier this year.

"It has taken longer than we thought, but we are finally getting there."