The Betashares Nasdaq 100 ETF (ASX: NDQ) has had a solid 2023, with the exchange-traded fund (ETF) up by 50% year to date. Is it too late to invest? I'm going to try to answer that question in this article.

Firstly, let's remind ourselves what the ETF actually comprises because that's key to understanding the investment.

BetaShares Nasdaq 100 ETF (NDQ) portfolio

The NASDAQ 100 holds 100 of the largest non-financial companies on the NASDAQ exchange in the United States. It includes companies introducing new products and services that are changing the world.

Many of the most powerful global businesses are within this portfolio, including Apple, Microsoft, Alphabet (Google), Amazon.com, Meta Platforms (Facebook and Instagram), Tesla, Nvidia and Costco.

Other portfolio leaders include Advanced Micro Devices, Adobe, Booking, Intuitive Surgical, Mondelez International, PayPal, AirBnB, ASML and so on.

There is a significant technological element to a lot of the companies involved, which I think is an attractive feature.

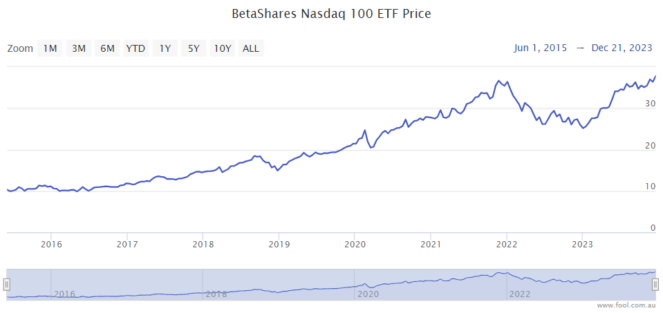

Close to record highs

The NDQ ETF has recovered from the pain of 2022 and has done very well. It's only slightly lower than where it was in mid-December.

Investors have shrugged off the high interest rates and are now looking ahead to when interest rates may be lower.

Earnings at many of the NDQ ETF's holdings have lifted and held up better than what investors may have expected a year or two ago, considering how much higher interest rates are compared to 2021.

Is it too late to invest in the NDQ ETF?

I think the below chart can be very helpful in looking at the situation.

We can see that the Betashares Nasdaq 100 ETF is close to its peak. But, it has reached a new high numerous times over the years and certainly can do so again.

It can be a mistake to think a good-performing investment that has hit a new high can't keep going higher, particularly if profit growth is helping justify a higher valuation.

If someone had said in December 2019 – at an all-time high – that it was too late to invest in this ETF, they'd have missed out on gains of more than 70% in the last four years.

However, there is no absolute guarantee that any investment will go up over any particular period of time.

It's quite possible that the market has gotten ahead of itself, particularly as interest rates remain high – and it could fall at some point in 2024.

However, I think the NDQ ETF can continue to perform well because of the quality of its underlying company holdings. With a five-year investment in mind, I'd be very happy to invest for the long term.