Macquarie Group Ltd (ASX: MQG) shares are in the green today.

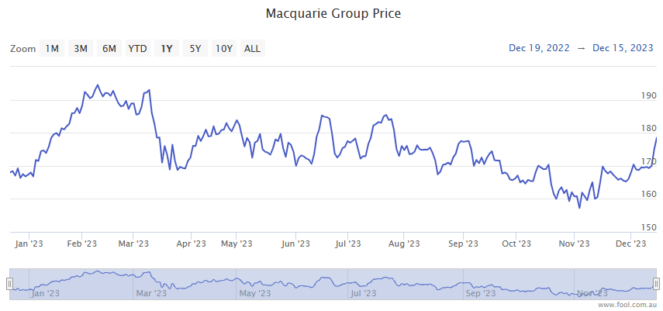

Shares in the diversified S&P/ASX 200 Index (ASX: XJO) financial stock closed yesterday trading for $179.34. In morning trade on Tuesday, shares are swapping hands for $179.61 apiece, up 0.2%.

That sees Macquarie shares up 9.1% in 2023.

For some context, the ASX 200 is up 0.2% at this same time today, and up 7.1% so far this year.

That's the latest price action for you.

Now if you own Macquarie shares, you should be looking forward to some handy passive income landing in your bank account today. Unless, of course, you've chosen to reinvest those funds.

Macquarie shares paying out today

If you owned Macquarie shares at market close on 10 November, you'll be eligible to receive the company's interim dividend of $2.55 per share, 40% franked.

The stock traded ex-dividend on Monday, 13 November. So, any shares you may have bought since then won't come with the rights to this interim dividend, which represents a payout ratio of 70%.

If you've owned shares longer-term, you'll already have received the $4.50 final dividend, paid out on 4 July. With a full-year payout of $7.05, Macquarie shares trade on a partly franked trailing yield of 3.9%.

This year's interim dividend was down 15% from the interim dividend of $3 per share paid the prior year.

That came amid some headwinds reported for its half-year results. This saw the company's net operating income drop 8% year on year for the six months to $7.91 billion. And net profit fell 39% to $1.42 billion.

Still the interim dividend was higher than consensus expectations and represents a 1.4% yield on its own.

The Dividend Reinvestment Plan (DRP) is in effect for this one. New Macquarie shares will be acquired on-market to satisfy the DRP.