The S&P/ASX 200 Index (ASX: XJO) stock Kelsian Group Ltd (ASX: KLS) might be an underrated ASX investment opportunity, according to an expert.

Kelsian Group is Australia's largest private operator of public transport, and it owns the largest fleet of electric buses in the country.

Fund manager Firetrail acknowledges that while buses might "sound boring", the investment opportunity "looks very exciting".

Why decarbonisation is so exciting

The Firetrail investment team spent some time recently with Kelsian.

As Firetrail pointed out, one of the best ways to lower Australia's carbon footprint was "to use cars less and public transport more".

The investment manager suggested that meeting transport decarbonisation targets would require 3.5x the number of public transport services over the next decade. To this end, New South Wales reportedly aims to increase the proportion of electric buses from 25% of buses on the roads today to 100% by 2026.

Firetrail also noted that Infrastructure Victoria CEO Dr Allison Stewart said recently that a better bus network was "the best solution for Melbourne's growing transport needs".

As the owner of the largest fleet of electric buses, the ASX 200 stock "will be a key beneficiary of increased bus services and the shift to electric."

Another benefit for Kelsian is that maintenance requirements of electric buses are "much lower" than internal combustion engine (ICE) buses.

At 30 November 2023, Kelsian Group was one of the top three 'overweight' positions in the Firetrail Australian Small Companies Fund.

Recent financial performance of the ASX 200 stock

In FY23, group revenue rose 9.3% to $1.42 billion, underlying earnings before interest, tax, depreciation and amortisation (EBITDA) rose 3.9% to $161.9 million, and underlying net profit after tax (NPATA) grew 4.3% to $70 million.

In a recent trading update, it said all divisions and geographies were performing well.

New Sydney contracts have transitioned "on time and on budget", and all contracts (and all of Western Sydney) are fully staffed.

The ASX 200 stock also said the Adelaide bus network was fully staffed and overtime had been normalised.

The AAAHI integration is progressing well, and the contract portfolio is growing, while domestic tourism demand is resilient despite the cost of living pressures.

Kelsian advised its focus was now on "operational synergies and leveraging scale advantages across all geographies."

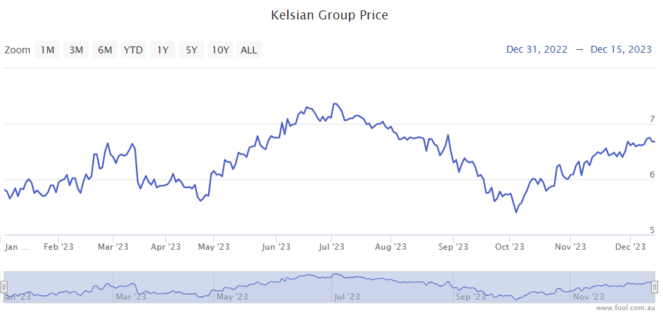

Kelsian share price snapshot

Since the start of 2023, the ASX 200 stock has increased by more than 20%.