Stock investors come from all walks of life — old and young, working class and wealthy, female and male.

Despite this diversity, everyone has a common goal.

To earn money.

Conversely, no one invests to lose money.

But the reality is that some, if not many, of your shares will end up in the red.

This is true whether you're a seasoned professional or a novice. That's just what happens. No investor has a perfect record.

If it was easy, everyone would do this instead of working.

But what one needs to remember is that, with proper diversification, your winners can more than make up for the losers.

You see, the most you can lose on a stock is 100% of the amount you originally invested. But the most you can gain on a stock is… infinite.

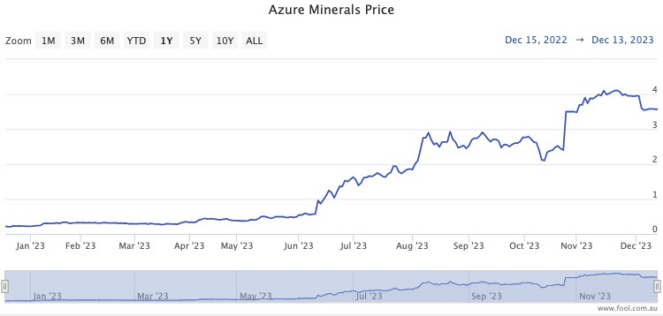

As an example, let's take a look at one explosive mining stock that could have single-handed lifted your portfolio into the stratosphere:

17-bagger in one year? Tell 'em they're dreaming

Mining exploration company Azure Minerals Ltd (ASX: AZS) hunts for gold and metal sources in Australia and abroad.

At the start of the year, you could have bought the shares for 22 cents each.

By April that had already doubled after reports of promising lithium findings in Western Australia. More favourable drilling results came through to lift to the high $1s in July.

Then all the news since then has been about corporate argy bargy.

First Chilean giant Sociedad Química y Minera de Chile SA (NYSE: SQM) lobbed in a takeover bid of $3.52 per share that the Azure board unanimously recommended shareholders take up.

But those plans were scuttled by Australia's richest person Gina Rinehart, who bought a 18% stake in Azure Minerals. Later Mineral Resources Ltd (ASX: MIN) joined the fray, buying up a double-digit piece of the pie.

With deep-pocketed investors all vying for it, Azure Minerals shares were trading at $3.75 on Friday.

That makes the mining stock a 17-bagger in less than a year.

So if you had the foresight to buy $6,000 worth of Azure shares at the beginning of 2023, you'd now have a cool $102,000.

Amazing stuff.

This means that you could have bought 10 other ASX shares for $6,000 each and your portfolio would still be well profitable even if those stocks all sunk to zero.

That, ladies and gentlemen, is why we diversify our portfolios.

And that is how you achieve everyone's dream of earning a handsome return on your investment.