The Australian stock market is dominated by just a pair of industries, namely mining and banks.

This level of concentration means index investing is not as diversified as some investors might think.

If you want to truly diversify, it's better to pick out individual ASX shares with a mindset that you'll hold onto them for as long as the original investment thesis still applies.

And perhaps steer clear of the stocks that seem cheap but are showing signs of unravelling.

Here are two good shares to buy and one to dodge:

Buy the dip on pharmaceuticals

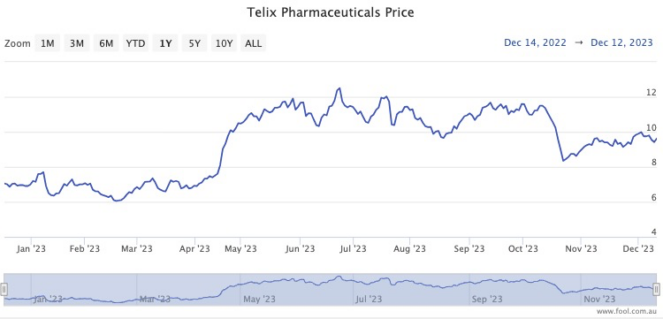

After suffering a violent 27% drop in October, Telix Pharmaceuticals Ltd (ASX: TLX) is climbing back again.

The share price has rocketed 21% since the 20 October trough, in a sign that the market is renewing its faith in the company's product pipeline.

An early stage healthcare stock like this will have such massive dips now and then. But if the business has positive prospects for the long run, it can be rewarding for investors willing to stick with them for years.

Telix has already shown it's capable of producing commercially successful products, with its Illucix cancer diagnostic tool bringing in nine-figure revenue over the last 18 months.

And with many solutions in development for other cancers due to arrive in the next few years, it's no wonder all seven analysts surveyed on CMC Invest rate it as shares to buy right now.

Lithium demand is only heading one way

Despite being the talk of the town the last few years, most ASX lithium stocks have had a shocker this year.

That's because the sagging economies both in the West and in China have seen global lithium prices plummet.

But in the long run, most experts believe demand will outstrip supply as electrification of cars, businesses and homes continues in the quest for lower carbon emissions.

As a company that already produces lithium, Mineral Resources Ltd (ASX: MIN) is in a great position to take advantage.

The share price is down about 32% since January, which BW Equities equity salesperson Tom Bleakley reckoned offered "good value".

"Mineral Resources has accumulated substantial stakes in quality lithium companies Wildcat Resources Ltd (ASX: WC8) and Azure Minerals Ltd (ASX: AZS)," he told The Bull this week.

"Mineral Resources' lithium exposure leaves it in a strong position as the industry matures."

Something smells here

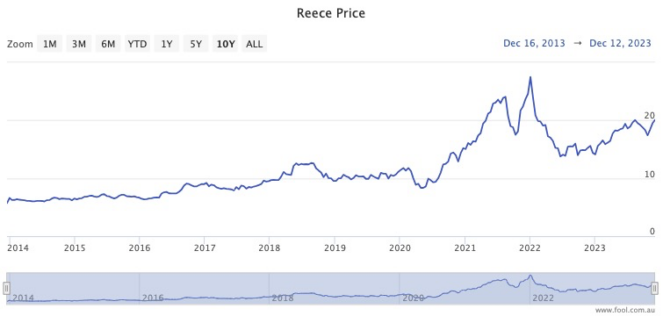

Plumbing and bathroom supplier Reece Ltd (ASX: REH) has made many investors wealthy over the past few decades.

However, perhaps its best days are now behind it.

The share price has admittedly rocketed more than 50% over the past 12 months.

Despite this, none of the nine analysts who cover Reece rates the stock as a buy at the moment, according to CMC Invest. In fact, seven of them recommend selling.

For various reasons, professional investors are generally reluctant to give out sell ratings. So such unanimous aversion is very telling.

Whatever is going on there, there are far more appetising choices on the ASX right now.