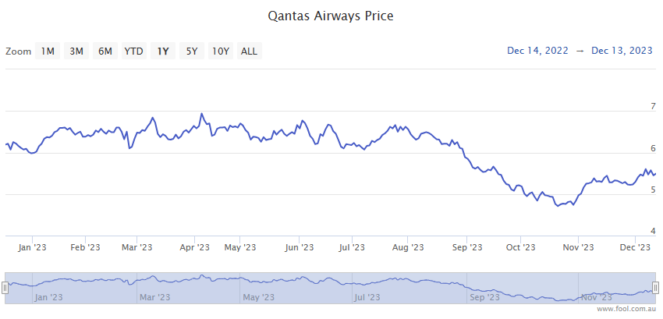

The Qantas Airways Ltd (ASX: QAN) share price didn't join the broader market rally yesterday.

Shares in the S&P/ASX 200 Index (ASX: XJO) airline stock closed Thursday down 1.1% at $5.34 per share.

After a troubling second half of the year, that sees shares in the flying kangaroo down 10% year to date.

For some context, the ASX 200 is up 6% so far in 2023.

So, what's all this then about an unexpected development that may boost the outlook for the Qantas share price in 2024?

I was hoping you'd ask!

Why this could boost the Qantas share price into 2024

Newly appointed CEO Vanessa Hudson is rolling out a series of customer improvement projects to help rebuild the ASX 200 airline's battered brand.

While that may lift investor sentiment over time, it's the broadly unexpected plunge in global oil prices that could offer some heady tailwinds for the Qantas share price into 2024.

Jet fuel costs are the second biggest expenditure for global airlines. The only bigger expense is the cost of buying or leasing aircraft. Those don't come cheap!

To give you some idea of just how much Qantas shells out for fuel, on 24 August the company forecast that its total fuel bill for the first half of FY 2024 would be $2.6 billion.

For some perspective, Qantas FY 2023 statutory profit after tax came in at $1.7 billion.

But things got worse from there, with rising jet fuel costs pressuring profits and the Qantas share price.

You see, on 24 August, Brent crude oil was trading for US$83 per barrel. But the oil price surged from there to hit US$97 per barrel by 27 September.

Noting the rising associated costs, on 25 September the ASX 200 airline reported:

Fuel prices have increased by around 30% since May 2023, including a 10% spike since August. This is driven by a combination of higher oil prices, higher refiner margins and a lower Australian dollar.

Qantas added that if the higher fuel costs were sustained, it would add some $200 million to its H1 FY 2024 fuel bill, bringing that to $2.8 billion.

In a sign that higher costs could impact the Qantas share price as the airline absorbed much of these costs rather than passing them on in the form of higher airfares, management said:

The group will continue to absorb these higher costs but will monitor fuel prices in the weeks ahead and, if current levels are sustained, will look to adjust its settings.

Any changes would look to balance the recovery of higher costs with the importance of affordable travel in an environment where fares are already elevated.

Fast forward to today

Now here we are, just over 10 weeks later, and a plunging oil price could offer some significant tailwinds for the Qantas share price.

At the time of writing, Brent crude is trading for just under US$75 per barrel. That's down some 23% since Qantas warned of a potential $200 million half-year increase in its fuel costs on 25 September.

And the oil price is down 10% since Qantas forecast a total fuel bill for the first half of FY 2024 of $2.6 billion on 24 August.

With the United States, the world's top oil producer, pumping record amounts of oil over the past few months in a trend that's expected to continue into 2024, OPEC+ may well find its production cuts can't get the oil price back up to levels we saw earlier this year.

While that may not be good news for the cartel's members, or ASX energy shares for that matter, it could offer the Qantas share price an unexpected boost in the new year.