As Australian investors head into Christmas, their thoughts will turn to what might happen to their ASX shares in 2024.

Fortunately, AMP Ltd (ASX: AMP) chief economist Dr Shane Oliver thinks it's "likely" that your portfolio will be fatter this time next year.

"2024 is likely to see positive returns helped by falling rates but they are likely to be more constrained, given likely volatility associated with the high risk of a recession," Oliver said on the AMP blog.

"Expect the RBA cash rate to fall to 3.6%, the S&P/ASX 200 Index (ASX: XJO) to rise to 7500 and balanced super funds to return around 5.3%."

That would mean that the ASX 200 would be around 4% higher than current levels, which would make 2024 a reasonable year.

But what about the "volatility" and "risks" that Oliver mentions?

Here are the four dangers investors need to look out for to protect their ASX shares:

Sticky inflation and recession

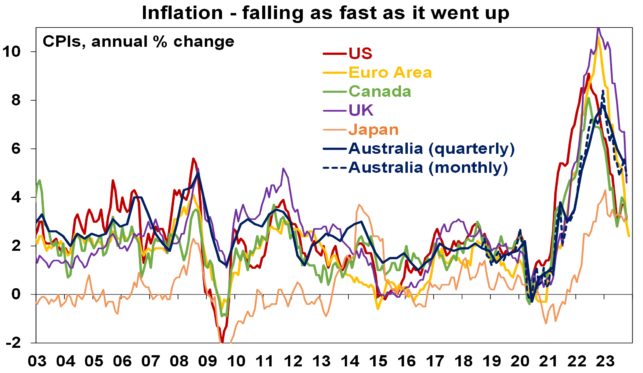

With all the talk about the end of interest rate rises, one could be forgiven for thinking unacceptably high inflation is behind us.

But it's not. The latest quarterly figure in Australia is still 5.4%.

"Inflation is still too high in most major countries – so central banks could still have another hawkish turn if it proves sticky above targets."

And if the rates are left high for too long, look out.

"The risk of recession is high, reflecting the lagged impact of rate hikes," said Oliver.

"It's hard to see how the biggest rate hiking cycle won't have a major impact and the risks are already evident in tighter lending standards in the US, falling lending in Europe and stalling consumer spending in Australia."

Exacerbating the worry is that, compared to a year ago, markets are now far more complacent about the chances of a recession.

The Chinese economy

China might seem a long way away, but the fact remains it is Australia's largest trading partner.

Thus the health of its economy is vital to many ASX shares.

The Asian giant has failed to reignite its economy to its usual vigour after it finally ceased COVID-19 restrictions late last year.

"Chinese growth has well and truly lost its lustre and property sector risks are high, but it's likely to target roughly 5% GDP growth again and back this up with more fiscal stimulus if need be."

US and world politics

There is a lot going on in the US in 2024.

"The US Government could have a shutdown starting 19 January and could have another divisive Biden v Trump presidential election, with a Trump victory running the risk of weakening US democracy and US alliances, and another trade war."

The European Union, India, Russia and South Africa are among other countries with major elections during the year, which could cause instability in geopolitics.

"The result of Taiwan's 13 January election could see an easing or an escalation of tensions with China depending who wins," said Oliver.

"The war in Ukraine is continuing, and there is a high risk that the Israel-Hamas war could spread, e.g. to Iran, threatening oil supplies."

Australia consumer activity and unemployment

Domestically investors need to keep a keen eye on how consumers are responding to the "lagged impact" of interest rate rises.

Especially critical is whether the unemployment rate starts rising.

"In Australia consumer spending, housing investment and business investment are not running at excessive levels relative to GDP.

"And there is still a large pipeline of home building work yet to be done providing some offset to the slump in building approvals, and business investment plans still point to growth — albeit slower than it has been."