After years of failed attempts, I finally own a slice of Queensland. Well, at least partially… the lender is the biggest shareholder of my humble abode for now. The purchase prompted a curious question from a friend, "So, have you liquidated all your ASX shares for the offset, Mitch?".

To their surprise, my response was swift and decisive, "Not a chance!" I replied. Not only had my share portfolio been spared of pillaging, but my collection of companies had increased following the property's settlement.

Quizzically, my friend proceeded to point out the exceptional savings from an offset.

For anyone unaware, an offset account allows money to be kept in a cash account against the home loan. The bank then only charges interest on the difference between the offset and the outstanding loan. Basically, $50,000 inside an offset translates to $3,050 in interest savings in one year, assuming a 6.1% variable interest rate mortgage.

Seems sensible, right? Here's why I still prefer buying ASX shares.

The simple reason I'm not cashing out

History is a powerful teacher. Though it won't provide the answer to the future, it informs us of the possibilities.

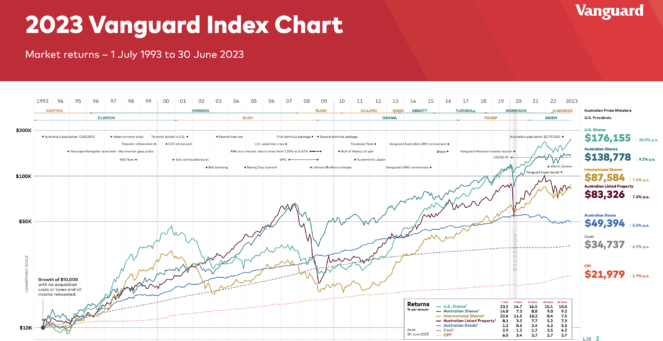

For a glimpse into the wealth-creating ability of investing in shares, I turn to the Vanguard Index Chart. Over the last 30 years, Australian (or ASX) shares have returned an average of 9.2% per annum. Likewise, US shares have served investors well, generating an average 10% per annum return, as shown below.

This doesn't mean the S&P/ASX 200 Index (ASX: XJO) will deliver a return exceeding the bank's variable interest rate every year — in fact, I'd say it's improbable. However, over a meaningful investment period — say 5, 10, 20, or 30 years — there's a good chance Australian equities will have averaged a better result.

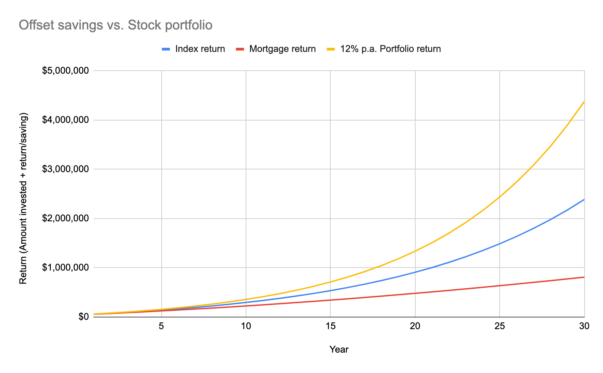

Below is a little hypothetical exercise in what the different capital allocation options could yield over the next 30 years. Assuming my mortgage averaged 6.1% per annum, the ASX 200 returns the same 9.2% p.a., and the off chance I outperform the index — averaging 12% p.a.

If I cashed out and moved $50,000 into my offset account, then proceeded to add $1,000 each month into the offset instead of investing it, I'd hypothetically save $807,920 over 30 years.

Meanwhile, the same amount invested into an ASX 200 exchange-traded fund (ETF) over 30 years could return $2.39 million before fees. But, if I can manage an average of 12% p.a. by picking high-quality companies, I could be staring at an incredible $4.38 million.

The type of ASX shares are critical

Before anyone goes throwing all their offset funds into stocks, there are two caveats I think are important to mention:

- I do use an offset account with my spare savings. But I won't sell any shares (ASX or otherwise) to increase the amount sitting there.

- There are no guarantees for stock market returns.

If I were to buy a bunch of speculative ASX shares, the equation could work out differently. The quality of the company determines long-term shareholder returns. Therefore, low-quality investments could see an average return below 6.1% in the long run.

That's why my portfolio is mostly comprised of profitable, proven businesses with clear competitive advantages. This includes investments in the likes of Pro Medicus Limited (ASX: PME), Jumbo Interactive Ltd (ASX: JIN), Apple Inc (NASDAQ: AAPL), and Meta Platforms Inc (NASDAQ: META).