The National Australia Bank Ltd (ASX: NAB) share price closed at $29.19 yesterday, down 0.44%.

As 2023 draws to a close, many ASX 200 companies are releasing their financial calendars for 2024.

Let's check out the important dates for investors.

(And while we're on the subject of 2024, let's canvas the views of a couple of major brokers to see where they think the NAB share price could be headed next year.)

The important dates for NAB shares investors

The NAB share price is more likely to move on days when the bank announces significant news.

Arguably, the dates we investors are most interested in are the dividend announcement days.

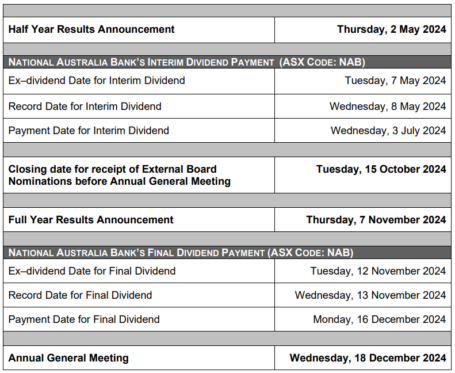

FYI — that's May 2 and 7 November, 2024.

By the way, we recently canvassed which ASX financial share will pay the best dividend yield in FY24 based on consensus forecasts. Check it out to see where NAB lands on the list.

Now grab your diary. Here are the important dates in 2024.

Expert tips on the NAB share price in 2024

Top broker Goldman Sachs reckons the big four bank is a buy. It has a 12-month share price target of $30.52 on NAB.

The broker explains that the business banking specialist will have an edge over the others in 2024. This is because it expects greater commercial volumes over housing volumes in the new year.

Goldman Sachs said:

[W]hile lending competition is intense, it has been skewed more heavily towards housing as opposed to business, which should benefit NAB's relative earnings mix.

NAB has delivered the highest levels of productivity over the last three years and its investments continue to yield benefits (A$400 mn of productivity expected in FY24E), which we think leaves it well positioned for an environment of elevated inflationary pressure.

UBS is less enthusiastic and has a sell rating on NAB with a share price target of $26.

The broker thinks NAB has reached peak earnings and could experience "lower than system lending growth, most notably in mortgages" over the 12 months.

Other downside risks include stronger competition in business banking, higher exposure to the business credit cycle, and the potential for costs to keep rising due to inflation.

For further reading, my Fool colleague Tristan recently pondered the outlook for NAB shares in 2024 as well as the outlook for ASX bank stocks in general.