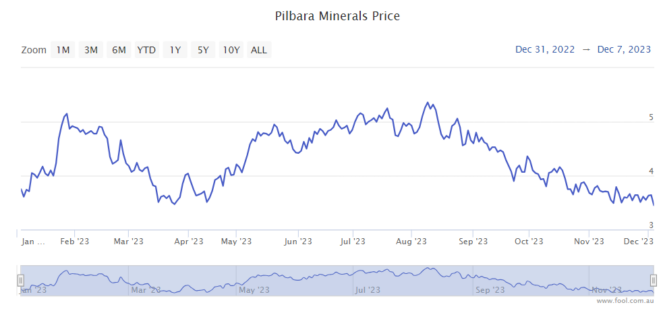

The Pilbara Minerals Ltd (ASX: PLS) share price has dropped by a third, or 34%, in just four months. Investors shouldn't feel completely negative though, as the ASX lithium share's CEO has said some encouraging words.

Let's quickly remind ourselves what's gone wrong in recent times.

Supply has caught up to demand

As most readers probably know, the lithium price has fallen significantly over the past 12 months. The commodity price is a key input for how much profit Pilbara Minerals can generate each quarter.

In the latest quarterly update, for the three months to September 2023, the realised price for Pilbara Minerals' spodumene concentrate was US$2,240 per tonne – that was down 47% year over year and down 31% quarter over quarter. That may be the main detractor from Pilbara Minerals shares.

Talking to Commsec's Tom Piotrowski, the Pilbara Minerals CEO Dale Henderson explained:

2023 has been this pullback and pricing, how do we contend with that? Well, we can't control pricing and pricing is a function of supply and demand balance.

But what gives us comfort as being a low-cost producer and being at the low-end of the cost curve, so we make sure that's front of mind for us and such that we can weather any ups and downs and other than that it's getting on with the job of delivery is really the focus.

What is the ASX lithium share aiming to deliver?

The company wants to deliver strong operational performance. In the first quarter of FY24, it produced 144.2kt of spodumene production. It's expecting the P680 primary rejection facility to deliver an extra 100kt per annum, with full-ramp up of the facility targeted for the second quarter of FY24. The P680 crushing and ore sorting facility ramp-up meanwhile is scheduled for the first quarter of FY25.

Following that, the company has its P1000 expansion project, which aims to increase the annual nameplate production run rate to 1 million tonnes per annum, with the first ore targeted for the third quarter of FY25.

It's also working with partners to gain more exposure to the lithium value chain.

With Calix Ltd (ASX: CXL), it's working on a mid-stream demonstration plant project that aims to show the benefits of producing mid-stream lithium-enriched product using Calix's patented electric kiln technology. This has the potential to reduce hard-rock lithium processing carbon emission intensity powered by renewable energy.

It's also working with POSCO to construct a lithium hydroxide monohydrate chemical facility in South Korea. The first train is/was on schedule for commissioning to commence in the second quarter of FY24, while train two Is on schedule to commence commissioning in the FY24 third quarter.

The ASX lithium share can't control the lithium price, but it can produce more of the commodity and be involved with more of the journey from spodumene concentrate to being battery-ready.

Pilbara Minerals share price snapshot

While it's down heavily in the last few months, it's only down by 2.5% in 2023 to date.