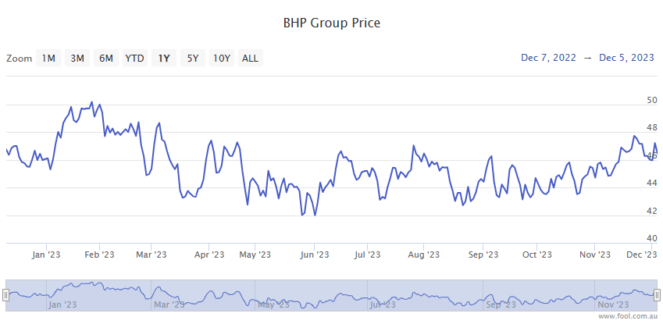

The BHP Group Ltd (ASX: BHP) share price is in the green today.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining giant closed yesterday trading for $47.23. In morning trade on Thursday, shares are swapping hands for $47.30, up 0.2%.

For some context, the ASX 200 is down 0.2% at this same time.

The BHP share price – along with rivals Fortescue Metals Group Ltd (ASX: FMG), up 1.7%, and Rio Tinto Ltd (ASX: RIO), up 1.2% – is outpacing the benchmark amid another boost in the iron ore price.

The industrial metal continues to trade above most analysts' expectations, gaining 2.2% overnight to US$131.85 per tonne.

But is BHP still undervalued?

Upside for BHP share price tipped

Investment bank Citi has increased its price target for all three of the big Aussie iron ore miners (courtesy of The Age).

Citi increased its target for the Fortescue share price to $22 while maintaining its sell rating. That still sees Citi's target 13.8% below the current Fortescue share price of $25.52.

The investment bank also increased its target for the Rio Tinto share price to $139 while maintaining its buy rating. That represents a potential upside of 8.6% from the current $128.02 a share.

As for the BHP share price, Citi increased its target by 8.8% to $49 a share, representing a potential upside of 2.1% from current levels.

Atop potential capital gains, BHP shares trade on a trailing dividend yield of 5.5%, fully franked.

What else is happening with Australia's biggest miner?

Atop Citi's upgraded outlook for the BHP share price, the miner also announced some top leadership changes this morning.

Commenting on the leadership shakeup, BHP CEO Mike Henry said:

These new appointments ensure that we continue to build organisational capacity, with the right mix of skills, experience and perspectives to deliver BHP's strategy and pursue our growth agenda.

Vandita Pant will take over as chief financial officer (CFO) on 1 March 2024. Pant joined BHP in 2016 and is currently serving as the miner's chief commercial officer. She's replacing current CFO David Lamont, who will remain with BHP until February 2025 as a senior executive officer in an advisory and projects capacity.

Rag Udd, currently President Americas, will take over the role of chief commercial officer from Pant.

Concurrently, Brandon Craig, currently asset president Western Australia Iron Ore will step into the role of President Americas.

And rounding out the leadership shakeup, Johan van Jaarsveld, currently chief development officer, has been appointed chief technical officer, also effective on 1 March. He's replacing Laura Tyler.

Henry thanked Tyler "for her commitment and contribution to BHP over almost 20 years".

He said she'd "made an outstanding contribution in multiple technical and operational roles across BHP and most recently supporting the growth of technology, innovation, exploration and ongoing continuous improvement at BHP".

BHP share price snapshot

Alongside a rising iron ore price, the BHP share price is back in the green for 2023, up 4.4%.