The Pilbara Minerals Ltd (ASX: PLS) share price is suffering today as the ASX lithium share suffers a rating downgrade from UBS.

The investment bank used to be neutral on the ASX mining share, with a price target of $3.75.

But, the company is now less optimistic on the lithium miner.

Pilbara Minerals shares downgraded

UBS has decided to cut its price target on Pilbara Minerals by 19% to $3.05, down from the previous price target of $3.75. It also downgraded the rating to a sell.

A price target is where the broker thinks the share price will be in 12 months from the date of the note. Previously, UBS was expecting a small rise for the Pilbara Minerals share price. But now, from the current valuation, the Pilbara Minerals share price is forecast to drop more than 13%.

Of course, there's no rule that says the ASX lithium share will fall from here, it's a forecast. The Pilbara Minerals share price could do better, or worse, than UBS is expecting.

Why is UBS negative?

UBS downgraded its forecast lithium price for 2024, 2025 and 2026 by 45%, 35% and 23% respectively, reflecting "weaker demand" and a continued supply response from "China Inc".

Due to the lower profit lithium price expectations, UBS decided to reduce its profit expectations for the relevant years. For Pilbara Minerals, the earnings estimates were reduced for FY24, FY25 and FY26 by 38%, 69% and 51%.

However, the long-term lithium price forecast of US$1,400 per tonne was unchanged.

UBS sees "no risk to production growth plans", but it is expecting the company to focus on the realised price for Pilbara Minerals' production and the company's declining cash balance, which it expects to reach A$900 million by June 2023, with "reduced operating cash flow in this heavy investment cycle."

Not every institution is negative

Last week I covered the ASX news that superannuation giant AustralianSuper had increased its position size in Pilbara Minerals shares to just over 153 million shares, bringing the stake to more than 5% of the ASX lithium share – a threshold that needs to be reported to the ASX.

It seems AustralianSuper is positive on the company's future at the current Pilbara Minerals share price, though it may be thinking about the ultra-long-term, not just what happens in the next year or two.

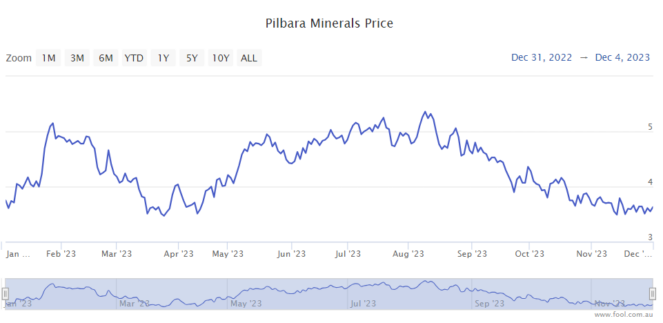

Pilbara Minerals share price snapshot

Since the start of 2023, the ASX lithium share is down by less than 3%, but it's down by more than 30% since 10 August 2023.