Pilbara Minerals Ltd (ASX: PLS) shares have found a new major backer. It's one of Australia's largest investment funds: AustralianSuper. The ASX lithium share has seen significant deterioration over the past year.

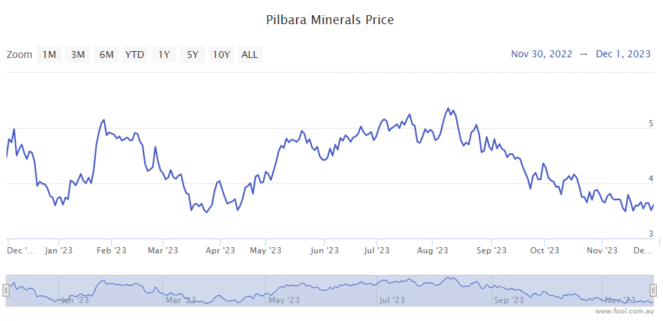

Compared to 12 months ago, the Pilbara Minerals share price is down 24% amid a heavy fall in lithium prices.

As reported by my colleagues, the short position in the company recently reached 18.5%, which is extremely high! The falling lithium price has seemed to embolden the shorters.

What has happened to the commodity price?

In November 2022, the business sold a cargo of 5,000 dry metric tonnes (dmt) of spodumene concentrate for US$7,805 per dmt. In the quarter for the three months to September 2023, it achieved a realised price of US$2,240 per tonne. It has seen a big decline.

The resource price is key because it plays such an important role in profitability. It costs a certain amount to process a tonne of material. Extra revenue for the same production is largely pure profit, while lower revenue for the same production largely comes straight off net profit before tax.

AustralianSuper buys Pilbara Minerals shares

The massive superannuation fund has been buying and selling Pilbara Minerals shares over the months, but it made some large investments at the end of October 2023 and made some more large investments on 23 November 2023 and 24 November 2023.

On 24 November 2023, AustralianSuper had built its position up to 153.36 million shares, with a stake of 5.10% of the ASX mining share.

Those major investments in November were done at share prices of between $3.58 to $3.65. At the time of writing, the Pilbara Minerals share price is within that range, so investors can buy at roughly the same price as AustralianSuper did.

The superannuation fund seems to be heavily interested in the investment theme of the energy transition and decarbonisation considering it has built up a large position in Origin Energy Ltd (ASX: ORG).

Is the long-term positive for ASX lithium shares?

While acknowledging Pilbara Minerals is naturally going to be bullish on its outlook, the company recently said:

Demand for lithium raw materials is expected to remain consistent in Q2 FY24 which is typically a stronger period for EV sales. Market pricing for spodumene concentrate and lithium chemicals is however likely to continue to remain volatile in the near-term given uncertain macroeconomic conditions and closely managed inventories in the supply chain. The long-term outlook for lithium materials supply remains positive with an expected structural deficit of lithium materials supply relative to the expected demand for lithium-based products such as electric vehicles and battery energy storage.

The longer-term movements of the lithium price could be very influential on where the Pilbara Minerals share price goes from here. AustralianSuper seems to be optimistic on what's going to happen for the battery commodity.