Joe Wright of Airlie Funds Management says investors are getting too caught up in rising interest rates and recent ASX shares volatility.

He reckons the market is simply returning to normal, which means "a normal, healthy level of uncertainty".

As he quips in an article published by the ASX today: "Uncertainty makes a market; it means dislocations and thus the potential for excellent investment opportunities."

He adds:

While the ascent of interest rates in Australia over the last 12 months has been remarkably rapid, the absolute level at which they sit now is hardly egregious relative to the last 30 years …

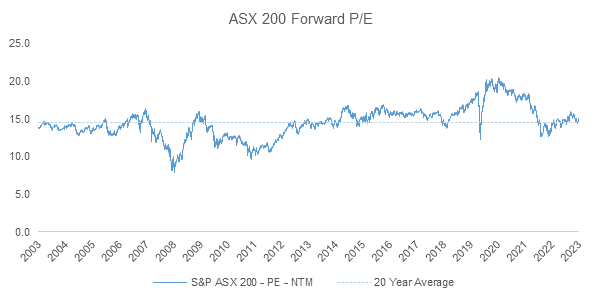

ASX valuations have returned to more or less the average of their last 20 years.

Source: Airlie Funds Management

The opportunities with ASX shares in 2024

In today's normalised market, Wright says Airlie will hold fast to two simple investment tenets to drive its decision-making.

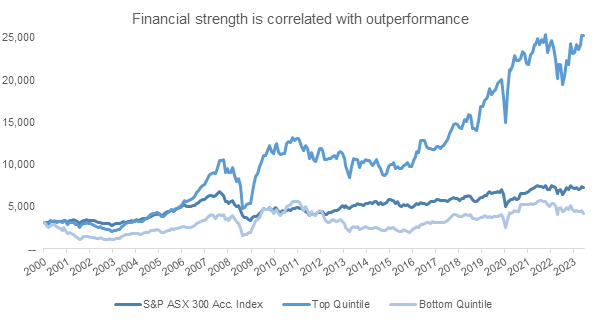

1. Healthy balance sheets correlate with long-term outperformance

Wright says the fund manager expects businesses with superior balance sheets to outperform their more highly geared counterparts.

The chart below shows that ASX shares in the top quintile for balance sheet strength (as measured by net debt to earnings) have outperformed the market significantly.

Source: Macquarie, Airlie Funds Management

2. Pricing power is about product differentiation

Higher inflation has prompted many companies to raise their prices. But Wright warns there is a difference between rising prices and 'pricing power'.

Pricing power due to product differentiation is more likely to lead to long-term profitability.

From Airlie's perspective, the most reliable indicator of business quality through the cycle is a consistently high return on capital which is often a function of pricing power …

Is it time to buy ASX small-cap shares?

Wright argues that when investors decide to 'risk-off' and focus on ASX blue-chip shares and value investing instead, it can mean "plenty of good companies and investment opportunities can get sold down in unison with lower equality companies in the index".

He commented:

Given the S&P/ASX Small Ordinaries (ASX: XSO) has underperformed the ASX 200 by around 20% over the past three years, Airlie sees 2024 as having potential for performance reversion, as long as investors steer clear of "concept" companies, businesses with excessive gearing and overly promotional management teams.

In 2023 to date, the ASX Small Ords shares index has lost 1.58% while the S&P/ASX All Ordinaries Index (ASX: XAO) has gained 1.95%.