The Origin Energy Ltd (ASX: ORG) share price is sliding today.

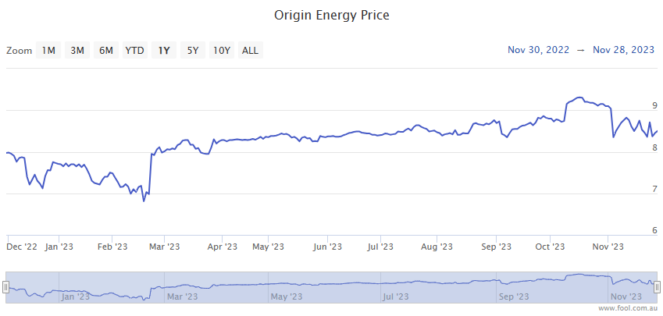

Shares in the S&P/ASX 200 Index (ASX: XJO) energy provider closed yesterday trading for $8.40. In late morning trade on Thursday, shares are swapping hands for $8.19 apiece, down 2.5%.

For some context, the ASX 200 is just about flat at this same time.

This comes as the energy provider's board issued a sour note on this week's revised takeover offer of Origin by a Brookfield-led consortium of investors and EIG.

Revised takeover offer simply too complex

The Origin Energy share price could be on track to close at fresh six-month lows today after the board announced that it considers the revised proposal "is not in the best interests of Origin or its shareholders".

The revised proposal led to the shareholder scheme meeting being delayed from 23 November until 4 December. The scheme requires 75% approval from shareholders to progress.

The total cash payment of approximately $9.43 per share remains unchanged under the revised proposal. A sum that's almost 15% above the current Origin Energy share price.

However, the revised scheme offers institutional shareholders the potential to re-invest into the Brookfield owned Energy Markets business.

It also provides for a potential alternative transaction in the event the scheme doesn't receive shareholder approval. This involves the sale of the Energy Markets business to Brookfield and a concurrent takeover bid by EIG for the shares in Origin.

The board, however, was not impressed.

Having unanimously supported the earlier offer, the board said the revised proposal is "incomplete and highly conditional, including requiring finalisation of funding arrangements, updates to regulatory approvals".

With that in mind, the board said it doesn't believe the revised proposal is in the best interests of Origin or its shareholders. The board said the new proposal is complex and does not provide sufficient certainty for Origin shareholders.

According to the board:

It is also the board's view that the value of the revised proposal does not adequately compensate shareholders, including taking into account the extended timeline that the revised proposal would require.

Further, it would require Origin to accept continuing constraints on the business following an already lengthy period for the current scheme.

Origin Energy share price snapshot

Despite today's dip, the Origin Energy share price remains up 8% in 2023.