With interest rates forecast to stabilise — or even drop — next year, many experts are tipping ASX shares to rise in the coming period.

But not all stocks are built the same.

How do you identify the cheap shares that have the most potential to rocket from here onwards?

The professionals at ICE Investors had an idea where investors could look:

Not all cheap shares are great value

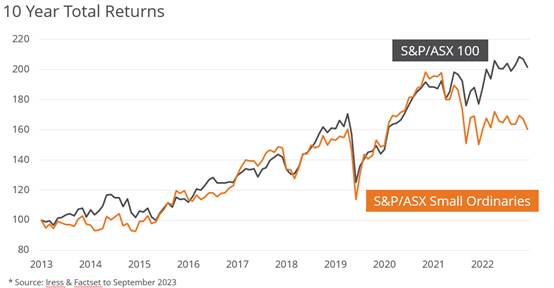

The ICE team points out that stocks in the S&P/ASX Small Ordinaries Industrials Index (ASX: XSI) have underperformed in recent times compared to their larger cap peers.

However, its research paper The Small Cap Dislocation states half of those small industrial stocks actually deserve to have depressed valuations, while the other half have been harshly treated.

"For the higher quality categories in the small industrials index, the underperformance of this group since the start of 2022 is not justified," said ICE portfolio manager Mason Willoughby-Thomas.

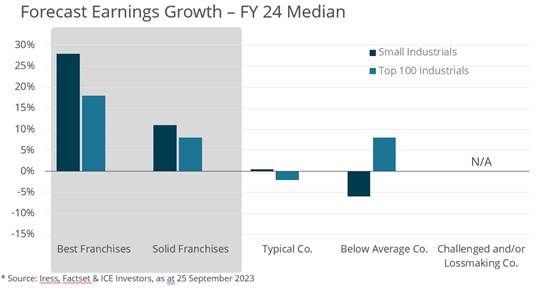

"The median quality small-cap franchise has better earnings growth, slightly lower debt levels and slightly higher profit margins than top 100 companies."

Meanwhile, the low-quality half is "materially inferior" to its larger-cap cousins.

Fear has driven investors to large cap ASX shares

The paper determined which stocks are the higher quality ones by categorising all small industrial stocks into one of five groups: best franchise, solid franchises, typical, below average, challenged/loss-making.

This "quality" grading was determined on the basis of earnings growth, profit margin and debt profile statistics.

The consensus forecast for earnings growth was then compiled for each company in those categories, then the same process was applied for the top 100 ASX industrials as a comparison.

The superiority of quality small industrials compared to large caps shows that the heavy discounting of the former has been fear-driven rather than fact-driven, according to portfolio manager Roger Walling.

"The more challenging investment environment has unsettled investors and they have responded by buying into the perceived safety of large cap stocks," he said.

"This sell-off in quality small companies has opened up very attractive buying opportunities for shrewd investors prepared to do the work and unearth quality companies with robust earnings growth, good profit margins and low debt levels."