In uncertain times like now, there is merit in sticking to the tried and trusted S&P/ASX 200 Index (ASX: XJO) names.

After all, those businesses are well known because they are dominant in their markets, have pricing power, and economies of scale.

Here are two such ASX 200 stocks named as buys this week:

'Undervalued at these levels'

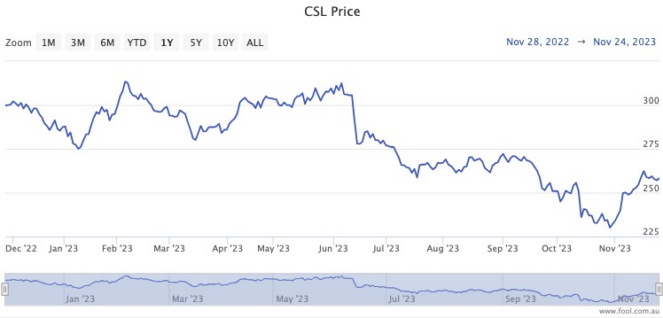

There's no doubt CSL Limited (ASX: CSL) was a market darling for three decades but has disappointed since the COVID-19 pandemic hit.

Over the past 12 months, especially, the share price has dived more than 14%.

Seneca Financial Solutions advisor Tony Langford reckons that makes CSL a bargain buy right now.

"At its recent annual general meeting, the company forecast 2024 revenue to grow between 9% and 11% at constant currency compared to fiscal year 2023," Langford told The Bull.

"It expects 2024 net profit after tax and amortisation in a range of about $2.9 billion and $3 billion at constant currency, an increase of between 13% and 17%."

One division, especially, has a lot of potential going forward.

"We believe this blood products group is undervalued at these levels given its brighter outlook."

Langford is far from the only professional who is bullish on CSL.

CMC Markets currently shows 14 out of 16 analysts recommending the ASX 200 stock as a buy.

'Highly popular and profitable'

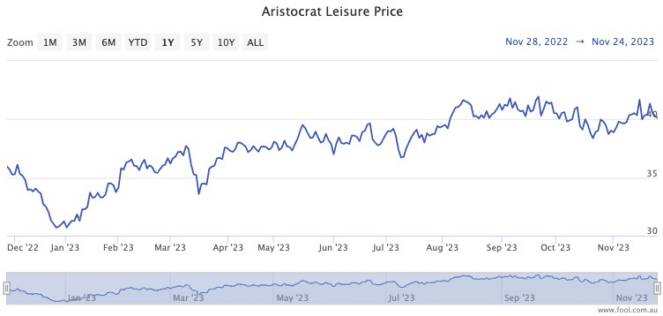

Meanwhile, Ord Minnett senior investment advisor Tony Paterno likes the look of Aristocrat Leisure Limited (ASX: ALL).

The Aristocrat share price has already risen 29% so far this year, with the company producing bumper results.

"The gaming company delivered a net profit after tax (NPAT) of $1.245 billion in fiscal year 2023, up 24.4% on the prior corresponding period," said Paterno.

There is much potential yet to be realised in overseas markets.

"We anticipate Aristocrat's highly popular and profitable electronic gaming machine titles [will enable] it to capture share in the key North American market.

"The proposed acquisition of NeoGames is expected to close in the first half of fiscal year 2024, with capabilities offering global scale and new distribution channels for the company's content in the real money games sector."

Like CSL, Aristocrat is also popular with those who invest for a living.

According to CMC Markets, a whopping 11 out of 12 analysts currently rate the ASX 200 stock as a buy.