ASX dividend shares that pay large dividends could be attractive opportunities if they pay dividend yields of at least 10% in FY25.

Keep in mind that the ASX share market has returned an average return per annum of around 10% over the ultra-long term. Being able to get that entire return just from income would be attractive and could only happen if the particular company is able to generate profit growth in the long term.

Of course, projections are not guarantees as no one can say for certain what payments shareholders are going to get in FY25 from ASX dividend shares.

Dusk Group Ltd (ASX: DSK)

For readers who don't know this business, it sells home fragrance products that are designed in-house. The offerings include candles, ultrasonic diffusers, reed diffusers and essential oils, as well as fragrance-related homewares.

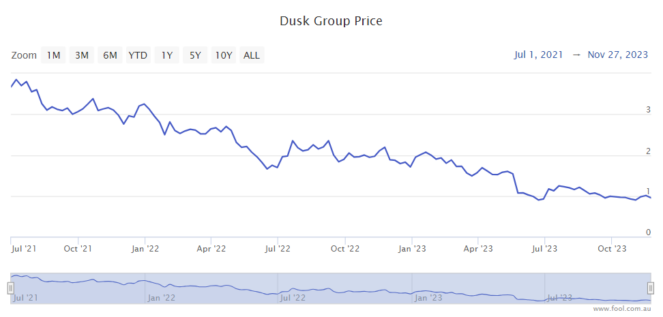

The Dusk share price has fallen enormously – it's down around 50% in a year and 76% from July 2021, as we can see on the chart below.

Retail conditions have worsened for the company. The trading update for FY24 saw total sales down 11.3%, but compared to the same period in 2019 total sales are up 30.1%, with a "slight improvement" in sales trends from October onwards.

It has continued to open new stores, with another six opened in the first half of FY24. It's expecting to open another four new stores in Australia in the second half and close one store.

The business has also opened three 'pop-up' stores in the run into Christmas, allowing it to test locations where it does not have a store and expand the footprint where it does.

In December 2023, the company is launching Dusk on the Amazon marketplace.

According to the projection on Commsec, the ASX dividend share could pay a grossed-up dividend yield of 15.3% in FY25.

Step One Clothing Ltd (ASX: STP)

Step One says it's a direct-to-consumer online retailer for innerwear. Its selling point is that it offers an "exclusive range of high quality, organically grown and certified, sustainable, and ethically manufactured innerwear that suits a broad range of body types."

The company points out that the addressable market in each of its key markets – Australia, the UK and the US – is "substantial" because underwear is "considered a need, not a want". The expansion into women's innerwear has increased its addressable market, with potential additions like bras and lingerie.

It's working on establishing partnerships, including a large retailer with a "loyal" customer base and a large membership organisation of "impeccable credentials". These partnerships will begin in early 2024.

Step One said it's exploring opportunities in new markets to gauge market interest and potential expansion.

According to the projection on Commsec, this ASX dividend share could pay a grossed-up dividend yield of 10%.