Share prices are changing all the time, so there are plenty of opportunities for investors to grab a piece of a company at cheaper prices. Fund manager Contact Asset Management has pointed out two S&P/ASX 200 Index (ASX: XJO) shares that could be good buys.

The Contact Australian Ex-50 fund is looking to balance capital growth and dividend income, providing access to a portfolio of quality Australian companies that sit outside the S&P/ASX 50 Index (ASX: XFL). The fund is aiming to deliver a total return of more than 10% per annum, after management fees and expenses.

In its latest monthly update, the fund manager has outlined two stocks that could be opportunities.

Vicinity Centres (ASX: VCX)

Vicinity Centres describes itself as one of Australia's leading retail property groups, with a number of retail shopping centres. A key investment is its 50% interest in the huge Chadstone shopping centre in suburban Melbourne.

Contact pointed out the ASX 200 share recently announced the acquisition of the remaining 49% interest in Chatswood Chase for $307 million, which is to be funded by debt facilities and asset sales.

The fund manager said the transaction supports Vicinity Centres' focus on premium assets, with the company also maintaining its earnings guidance at its AGM while its operating trends are "solid".

Contact believes the Vicinity Centres share price is at a "significant discount to its asset backing" and sees it as "compelling value".

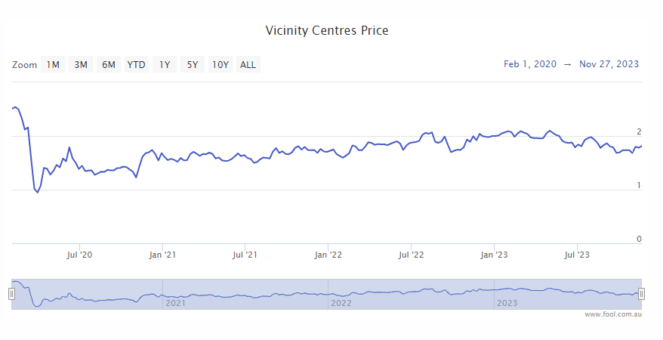

The Vicinity Centres share price is still down more than 25% from its February 2020 level.

Hub24 Ltd (ASX: HUB)

Hub says its platform offers financial advisers and clients a comprehensive range of investment options. According to the company, these include "market-leading managed portfolio solutions, and enhanced transaction and reporting functionality". It also owns Class, a cloud accounting provider for trusts and self-managed superannuation funds.

Contact pointed out that Hub24 reported net inflows of $2.8 billion for the three months to September 2023.

The fund manager said the ASX 200 share's performance was in line with market expectations, though the rate of growth is outpacing its peers, which the fund manager called positive.

Contact wrote:

We continue to believe that HUB is well positioned to gain market share from incumbents. The long-term tailwinds from a growing Australian superannuation pool is important. According to ASFA, it is expected that super assets in Australia will grow from $3.5 trillion in 2023 to near $10 trillion by 2040.

The Hub share price is up 22% in 2023 to date but down 3.5% over the past week, as you can see on the chart below.