Passive income in the tens of thousands each year might seem like the stuff of dreams, but it's well within the reach of the average Australian.

And it doesn't require constant buying and selling, which takes time and money.

If you employ a buy-and-hold strategy of quality ASX shares over the long run, there is no reason why you can't turn a $250 monthly investment into $25,000 of annual income without too much effort.

Here's how you could do it:

From little things big things grow

Comparison site Finder recently found Australians had an average of $40,000 saved up.

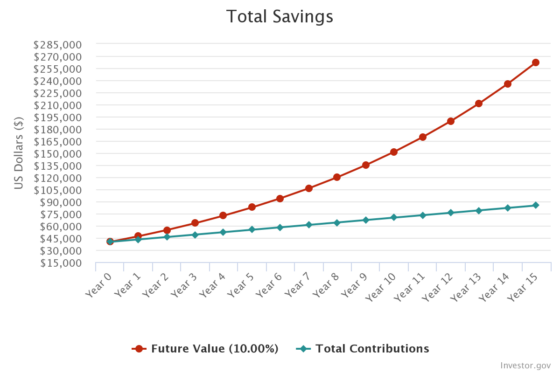

Let's start a stock portfolio with that, then add $250 to it each month.

If the portfolio can return 10% compound annual growth rate (CAGR) in the long term, you are on your way.

After 15 years, you'll find the pot has grown to a tidy $262,407.

What type of ASX shares should one buy to go from $40,000 to $260,000? Growth or dividend?

It actually doesn't matter.

I have a personal preference for growth shares, but the ASX is blessed with many high-performing dividend stocks that could easily provide you 10% CAGR.

You just need to make sure any dividends are immediately reinvested along the way, so that they will contribute to your 10% goal.

Don't create more work for yourself

If you don't want to be buying, selling and stressing on a daily basis, you will want to pick quality businesses with long-term drivers.

Even still, it's prudent to review your holdings every month or quarter to make sure your investment thesis for each stock still holds up.

If it doesn't, then ditch and find another stock that satisfies your criteria.

You will also want to diversify the portfolio. This can be in terms of industries, geography or client demographics.

This will also smooth out the journey so that you don't have to maintain the portfolio as regularly.

Now, with $262,407, how do we get $25,000 of passive income out of it?

Easy. If the portfolio can maintain 10% CAGR, instead of reinvesting it, simply cash out.

Then you will be pocketing an average of $26,240 of passive income each year.