The Star Entertainment Group Ltd (ASX: SGR) share price has lost 10% of its value this week as the beleaguered casino operator continues its remediation work.

Star Entertainment shares are currently trading for 50 cents, up 0.4% on Friday but down 10.4% this week.

The casino operator says it is working hard to restore shareholders' faith following the indefinite suspension of its gambling licence in NSW and the deferred suspension of its licence in QLD.

The suspensions followed separate inquiries in each state that found Star Entertainment unsuitable to hold a casino licence.

The company is now in the thick of remediation planning to return to suitability in both states.

This week, we saw four ASX announcements released by the company.

Let's review the latest news from Star Entertainment.

Appointed regulatory managers to stay longer

The NSW Independent Casino Commission (NICC) has advised The Star that it wants Sydney Casino's special manager Nicholas Weeks to stay in the job longer.

The NICC appointed Weeks in October 2022 to monitor operations and oversee The Star's remediation planning. In December 2022, the NICC extended his original 90-day term to 19 January next year.

The NICC now wants Weeks to remain in place until 30 June 2024 and says this will be the final extension.

In a statement, Star Entertainment said:

The NICC has advised The Star that the proposed extension is to give The Star additional time to

satisfy the NICC that it is capable of undertaking the remedial action required for it to become suitable and be permitted to return to gaming in accordance with the provisions of the Sydney casino licence.The Star is continuing to engage with the NICC and the Manager in relation to its remediation plan as it relates to the Sydney Casino (which is yet to be approved in New South Wales) and other matters.

Star Entertainment also announced a 12-month extension on its QLD manager's term to 8 December 2024.

QLD remediation plan approved

In a separate announcement today, Star Entertainment said the QLD Attorney-General has approved its remediation plan.

The plan comprises about 640 milestones that the company says it will implement over a multi-year period.

Additionally, the 90-day licence suspension for The Star Gold Coast and Treasury Brisbane casinos has been postponed from 1 December to 31 May next year. The casino operator will have to prove to the QLD Government by that date that it is implementing its plan and returning itself to suitable status.

The Star's Group CEO and managing director, Robbie Cooke, said:

We're pleased to have our Remediation Plan approved in Queensland.

It's an important step on our path to returning to suitability in Queensland and will track and hold us accountable throughout the multi-year program we are committed to delivering.

NSW casino duty rates agreed

In other news this week, the Star Entertainment share price fell 1.85% on Tuesday amid another announcement. The Star advised investors that it had signed an agreement to formalise NSW casino duty rates.

Cooke said:

The formalisation of these arrangements protects our Sydney team's jobs and enables us to continue the important ongoing work required to restore The Star Sydney to suitability, and to earn back the trust of our stakeholders.

Director ups his stake by 65%

Amid all this other news, we learned that Star Entertainment director David Foster upped his personal stake in the company on Tuesday.

Foster purchased 35,398 Star Entertainment shares on-market at a share price of 56.25 cents apiece.

This increased his indirect holdings in Star Entertainment by 65% from 54,702 shares to 90,100.

Star Entertainment share price snapshot

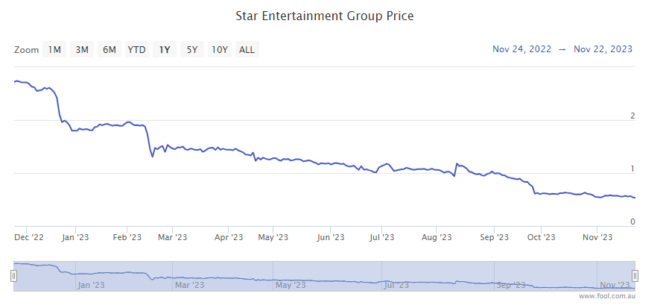

Investors have trashed the Star Entertainment share price over the past 12 months.

It is down by 78%.