The Woodside Energy Group Ltd (ASX: WDS) share price is underperforming the benchmark today.

Shares in the S&P/ASX 200 Index (ASX: XJO) oil and gas stock closed yesterday trading for $32.04. During the lunch hour on Thursday, shares are swapping hands for $31.71, down 1%.

That's twice the 0.5% losses posted by the ASX 200 at this same time.

So, why is the Woodside lagging today?

What's happening with the ASX 200 oil energy share?

With no fresh price sensitive news out from the company, the Woodside share price looks to be pressured by an unexpected overnight drop in the oil price.

Brent crude oil tumbled 5.1% overnight to a low of US$78.41 per barrel, before recouping much of those losses. Brent is currently trading for US$81.96 per barrel, down 0.6%.

This came following news that the Organization of the Petroleum Exporting Countries and its allies (OPEC+) have pushed back their scheduled 26 November meeting to 30 November.

Now a four-day delay may not seem like much. But it's the cause of that delay that's seeing oil prices, and the Woodside share price, slide.

While Saudi Arabia and some of the wealthier members appear intent on extending and even increasing the cartel's production cuts into 2024, Angola and Nigeria aren't so keen. But with the United States producing record, and world leading, amounts of oil, a failure by OPEC+ to limit output could see oil prices fall further amid swelling supplies.

Woodside share price snapshot

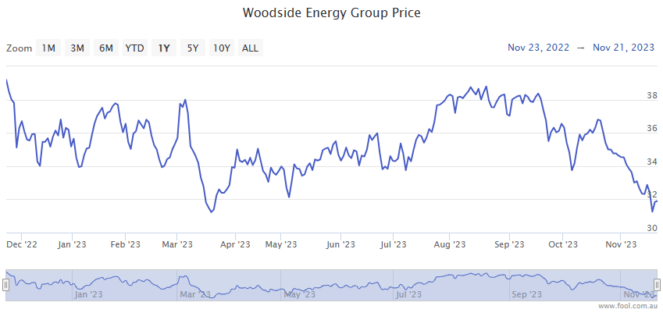

Amid a 5% decline in the oil price in 2023, the Woodside share price has dropped 10% year to date.