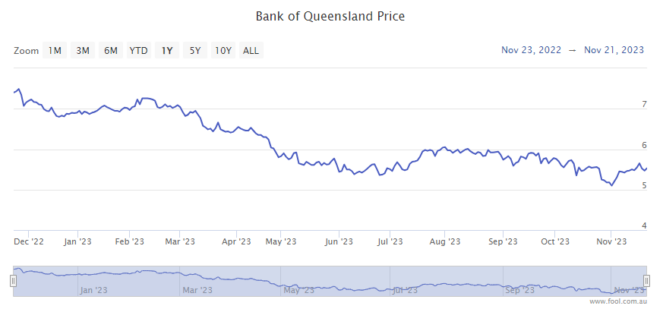

Bank of Queensland Ltd (ASX: BOQ) shares are among the top 10 most shorted shares of the ASX today.

As my colleague James reported earlier this week, the regional bank has a short interest of 8.8%.

James reckons the likely contributors to the ASX bank share's short interest are "weak volume momentum, intense competition in mortgage loans, and inflationary pressures on costs".

Are the short sellers right?

Bank of Queensland shares lower on Thursday

The Bank of Queensland share price is currently down 0.09% to $5.54.

Harrison Massey of Argonaut has a sell rating on Bank of Queensland stock.

Massey explains on The Bull:

Investors were disappointed with its full year 2023 result, with cash earnings after tax of $450 million representing an 8 per cent fall on the prior corresponding period.

The lending market is highly saturated and the bank experienced slower levels of credit growth and higher funding costs, which increased its operating costs by 8 per cent.

Other financial institutions appeal more at this time.

Interested in buying?

My colleague Tristan discusses whether the Bank of Queensland represents a deep-value opportunity.

He notes that ASX bank shares face various headwinds today, including strong competition between lenders and higher interest rates threatening to increase bad debts and reduce demand for new loans.