The Qantas Airways Ltd (ASX: QAN) share price is catching some headwinds today.

Shares in the S&P/ASX 200 Index (ASX: XJO) airline stock closed yesterday trading for $5.34. In morning trade on Wednesday, shares are swapping hands for $5.26, down 1.4%.

For some context, the ASX 200 is up 0.13% at this same time.

This comes as new data reveals the airline is still struggling to get domestic customers into the air and to their destinations on time.

What's happening with ASX 200 airline?

The Qantas share price won't be getting a lift from the October Airline On Time Performance Statistics report, released by the Bureau of Infrastructure and Transport Research Economics (BITRE).

That report shows Qantas was the least reliable domestic carrier across most metrics.

When it came to cancelled flights, Qantas had the ignominious honour of leading the pack, with 4.3% of its flights scratched over the month. Qantas subsidiary Jetstar and Virgin Australia were the second worst performers here, both cancelling 4.1% of their flights in October.

They were followed by QantasLink at 3.6%, Virgin Australia Regional Airlines at 3.2%, and Rex Airlines at 2.3%.

Cairns-based Skytrans had the least cancelled flights in October, at 1.8%.

As for the flights that weren't cancelled, BITRE noted that October's on-time arrival figures for all domestic airlines were "significantly lower than the long-term average performance". On-time departures were also lower than average, while cancellations ran higher than the norm.

And here again, the Qantas share price is unlikely to get a boost from how the airline performed in October.

Of the major domestic airlines, Virgin Australia had the highest on-time arrivals at 68.6%, followed by Jetstar at 68%, with Qantas again trailing the pack at 66.6%.

The same picture arises for on-time departures in October, with Virgin Australia again flying in the lead at 68.9%, followed by Jetstar at 66.4%, and Qantas at 65.1%.

Qantas reported its flights had been impacted by bad weather throughout October on all but six days of the month.

All the domestic airlines are still struggling with staffing shortages, and some also pointed to ongoing air traffic control issues for delays and cancellations.

Qantas share price snapshot

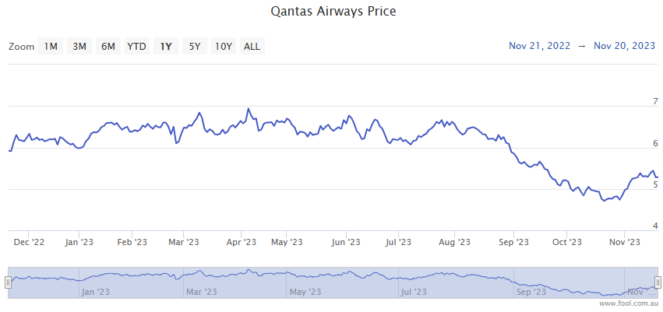

The Qantas share price is down 11% year to date although investors who bought the ASX 200 airline stock one month ago will be sitting on gains of 10%.