The BHP Group Ltd (ASX: BHP) share price is marching higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining giant closed yesterday trading for $46.74. In afternoon trade on Tuesday, shares are swapping hands for $47.49 apiece, up 1.6%.

That puts the BHP share price up an impressive 9.7% since this time last month.

So, what's driving ASX 200 investor interest?

Why is the ASX 200 mining stock outperforming?

It's not just the BHP share price that's outperforming today.

Shares in rival ASX 200 iron ore miner Fortescue Metals Group Ltd (ASX: FMG) are up 1.38% while the Rio Tinto Ltd (ASX: RIO) share price is up 2.11% at this same time.

Much of those tailwinds look to be coming from another uptick in the iron ore price.

The critical steel-making metal, the biggest revenue earner for BHP, gained 1.7% overnight to trade at US$130.70 per tonne. That's the highest level since March, and up from US$104 per tonne in mid-August.

The strength in iron ore prices also helped the BHP share price gain 1.2% on the New York Stock Exchange overnight, where the stock is also listed.

Shareholders look to have China, the world's top importer of iron ore, to thank for the strong performance, with tailwinds blowing from two fronts.

On one, traders are positioning themselves for an expected increase in demand as China's factories restock inventories ahead of February's Lunar New Year holidays.

And on the other front, the Chinese government appears set to unleash some major stimulus to spur its struggling economy. The steel-hungry Chinese property sector has been particularly sluggish, but that could be about to change.

Citing sources familiar with the matter, Bloomberg reports the Chinese government intends to provide at least one trillion yuan (US$137 billion) of low-cost financing to boost the nation's housing markets.

BHP share price snapshot

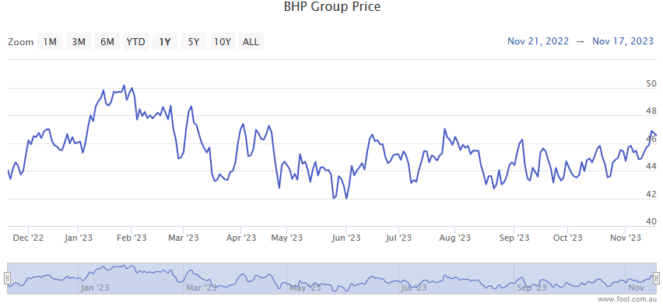

With iron ore prices on the rebound, the BHP share price is up 11% over the past 12 months.