The last month has been a fruitful time of investing in ASX shares for my portfolio. In fact, I've put a lot of my saved (investment) cash to work.

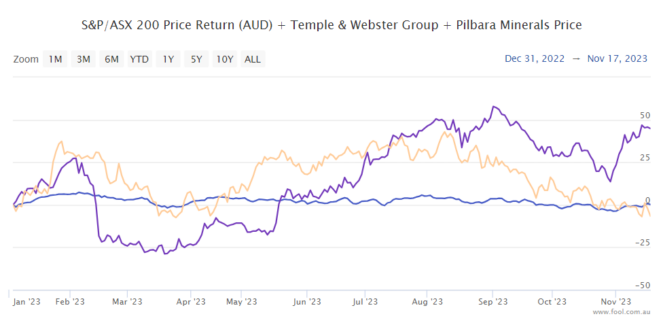

When we look at a chart of the S&P/ASX 200 Index (ASX: XJO) (in blue on the chart below) over the course of 2023, there is some volatility. But there are much bigger changes when we look at the individual share prices of names like Pilbara Minerals Ltd (ASX: PLS) (in yellow) and Temple & Webster Group Ltd (ASX: TPW) (in purple). Certainly, those bigger movements can be opportunities.

Why I put a lot of cash into the ASX share market

I decided to use a shorter-term decline to invest in companies that have good long-term prospects.

I'd agree with the saying that 'time in the market is better than timing the market'. But I'm not going to invest in things that seem expensive to me, nor do I want to choose cheap, rubbish companies.

Share prices don't often fall by 10%, 20%, 30%, or more so I want to take advantage of those times when they come along — and I'm going to back myself when valuations seem too good to ignore.

Share prices usually only fall heavily when there's something to be truly worried about, and sometimes we'll see a large number of those names recover quite quickly. I was very fortunate with the timing of my investments – four of them have gone up more than 14% already.

I've written about nearly all of the names that I've invested in.

In this article, I covered my thoughts about Temple & Webster, Lovisa Holdings Ltd (ASX: LOV), Pinnacle Investment Management Group Ltd (ASX: PNI), and Johns Lyng Group Ltd (ASX: JLG).

After share price declines of more than 50% for Elders Ltd (ASX: ELD) and Centuria Capital Group (ASX: CNI), I decided to make contrarian plays for both of these stocks, which I covered here and here, respectively.

I've also gone for the beaten-up ASX lithium share Pilbara Minerals which I wrote about here.

I'm not expecting that all of these stocks are going to be in my portfolio until I'm 100. Some of them may only be holdings for three or four years if there's a strong economic rebound in the recovery phase from the current uncertainty.

What now?

I haven't invested every last dollar. I may make one more investment during this burst.

I'm also going to start rebuilding my cash pile and watch the dividends roll in.

But I don't want to sit on the cash forever, even though it is producing solid returns now. It's great that holding cash can give us an interest rate return that starts with a '5' in percentage terms.

With how much economic uncertainty and change there has been, the next 12 months could also open up opportunities, particularly if some individual companies underperform short-term expectations. That may be another chance to invest in companies that look like cheap buys.