Pilbara Minerals Ltd (ASX: PLS) shares are among the latest additions to my retirement investment portfolio after the company's recent pain.

Just to be clear, I'm not expecting to hold this stock until I retire. It's just part of my growth-focused portfolio which has a goal of helping fund my future retirement. Compared to my normal investment timeframe of many years, this could be a somewhat shorter holding.

Let's take a look at why.

Why I invested in Pilbara Minerals shares

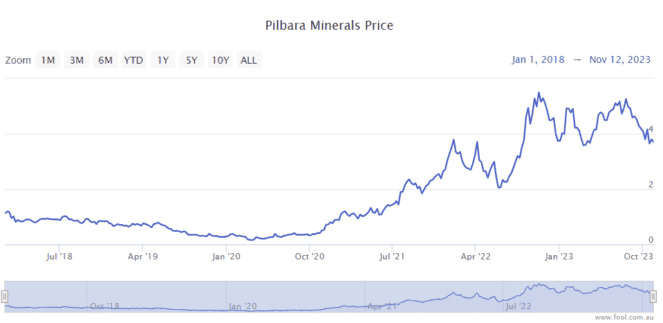

The ASX lithium share has seen plenty of volatility since the start of 2018. Just look at the chart below.

Since 10 August 2023, Pilbara Minerals is down more than 30%. This is a significant underperformance of the S&P/ASX 200 Index (ASX: XJO) which is only down by 5.2% over the same time period.

The ASX mining share seems to experience much more volatility than many other businesses on the ASX that have market capitalisations above $10 billion. However, regular, heavy sell-offs can be opportunities to buy while Pilbara Minerals shares are being discounted by the market.

That said, I don't just invest in a company because it has fallen. I want to see that the underlying business has a positive long-term future with both demand and operational growth.

The lithium price has sunk over the last several months — and compared to a year ago. I'm not going to try to make a lithium price forecast but I'm confident the long-term relationship between supply and demand of lithium looks promising.

Pilbara Minerals is certainly confident too. The company believes the expected deficit in lithium supply by 2040 will be the equivalent of between 13 to 21 Pilgangoora projects, depending on potential supply coming online. The longer time goes on, the wider the deficit is expected to be in the coming years. Certainly, electric vehicles, household batteries, and industrial batteries could all contribute to strong demand.

Other positives

As well, the ASX lithium share has a really strong balance sheet, with $3 billion in cash and no debt. This backs up some of the Pilbara Minerals share price.

The company is extremely well-funded to continue dividend payments and invest in its own growth, which is very compelling. It's also working its way towards the production of 680,000 kt of spodumene concentrate, and then one million kt after that.

As well, a study is underway to potentially increase the 'nameplate' production capacity above one million tonnes per annum. It follows a recent 35% increase in the Pilgangoora ore reserve. This has extended the mine life by nine years to around 34 years, which means more potential profit for the company.

I'm also really attracted to the fact the company is investing to capture more of the lithium supply chain — and profit margin — with joint venture partners POSCO and Calix Ltd (ASX: CXL). This could help deliver more cash flow in the future when all of its currently planned projects are completed.

ASX lithium share valuation

According to the projections on Commsec, the Pilbara Minerals share price is valued at 12 times FY24's estimated earnings and the company could pay a grossed-up dividend yield of 3.2%.

As I said, I'm not expecting to hold this one forever. If Pilbara Minerals ever went back to its 52-week high, I'd certainly think about taking profit off the table.