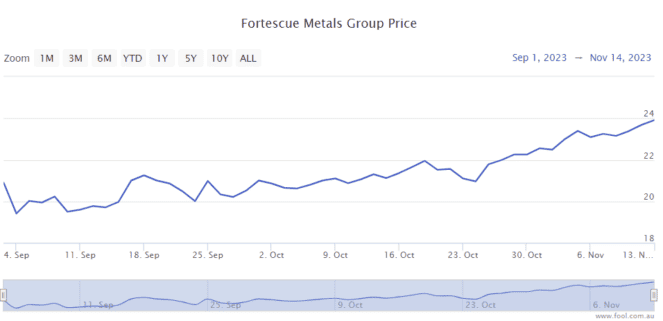

Fortescue Metals Group Ltd (ASX: FMG) shares are having a strong finish to the year. Since 8 September 2023, the ASX mining share has risen around 25% as we can see on the chart below. How is the outlook shaping up for 2024?

Just as a reminder, Fortescue is one of the largest ASX iron ore shares and it also has an expansive portfolio of potential global projects that could produce green hydrogen and green ammonia in the future. It also has ambitions to be a world-leading battery business for advanced and heavy machinery.

The Fortescue share price has seen plenty of volatility in recent times. Let's look at what could happen in the next 12 or so months.

2024 outlook

A key part of the picture for Fortescue is the iron ore price. That's currently where nearly all of its revenue comes from. It produces a huge amount of iron ore – in the three months to September 2023, it shipped 45.9 million tonnes (mt). It's expecting to ship between 192mt to 197mt in FY24, including approximately 5mt from high-grade iron ore project Iron Bridge.

The main other factor for iron earnings is the price that Fortescue gets for its production.

According to Trading Economics, the iron ore price has risen to US$130 per tonne, defying some expectations that it was headed below US$100 per tonne in the last few months of the year.

Goldman Sachs now has a three-month target of US$130 per tonne on the iron ore price, and suggests that the iron ore market is "set for a clear deficit". It has been partly helped by lower iron ore supply coming from Brazil and China. My colleague Bernd Struben reported on Goldman Sachs analyst Snowdown's comments:

The path into 2024 now points to a balanced market versus previous surplus, suggesting no imminent glut risk ahead. With onshore mill restocking likely ahead of Chinese New Year and low supply chain inventories, price resilience with greater risk to the upside than downside is now the year-end setting.

Trading Economics has forecast that the iron ore price can reach US$133 by the end of the quarter, according to global macroeconomic models and analysis expectations. Trading Economics has also estimated that the iron ore price can rise to US$142 per tonne in a year from now.

Iron ore will likely be the key factor in how much profit Fortescue makes in 2024, and therefore have the biggest influence on Fortescue shares.

Energy progress

Fortescue is working towards a current target of five final investment decisions for its global portfolio of green energy projects in the shorter term.

Positive progress in this area could give shareholders a boost, but it isn't expected to be producing any meaningful levels of green hydrogen in 2024.

I'm interested to see if the business announces any projects relating to any other commodities that may assist its green energy efforts, such as copper, nickel, lithium and so on. It is currently looking for commodities in that decarbonisation area.

Valuation of Fortescue shares

Based on the forecast on Commsec, the Fortescue share price is valued at less than 10 times FY24's estimated earnings and it could pay a grossed-up dividend yield of around 8%.