I don't think it's controversial to suggest most people who read The Motley Fool want to achieve financial freedom.

Of course, what that means is open to interpretation, depending on your personal circumstances.

But I dare say for many readers financial freedom equates to no longer being obliged to work and living off passive income.

A realistic way to reach this destination is to build a portfolio of quality ASX dividend shares whose distributions could regularly form a nice deposit into your bank account.

So how can we reach such a state of dividend income nirvana?

How much dividend income do I need to give up work?

Let's work backwards.

How much dividend income would you need per year to be able to give up work?

According to the Australian Bureau of Statistics, the median employee earnings stand at $1,250 per week. That equates to an annual income of $65,000.

The government's Moneysmart website then advises Australians that a rough guide to adequate retirement income is reaching two-thirds, that is 67%, of your pre-retirement salary.

That means we're seeking $43,333 of dividend income each year to give up your day job.

So let us now answer the question that the headline poses.

How big does the nest egg need to be?

Fortunately, Australian investors are blessed with favourable tax rules for dividend investing.

The laws are designed so that investors do not pay tax twice.

So this means that if a company has already paid tax on its profits, any dividends coming out of that will come with franking credits to indicate personal income tax does not need to be paid.

This provides an incentive for ASX shares to return capital to investors via dividends rather than alternative methods, such as buybacks.

Hence Aussie dividend stocks pay out yields that would make American investors faint in disbelief.

In my opinion, with careful research, it is realistic to achieve a 10% dividend yield with the help of franking.

This also makes the maths easy — $43,333 in yearly dividend income would require a $433,333 portfolio.

How do I grow my portfolio to that size?

That's great news for those who have $433,333 just laying around.

You can retire now.

But for those of us who don't have that level of spare cash, it will take some time to grow a nest egg to that level.

Fortunately, using the power of compounding and ASX shares, this is also very much achievable.

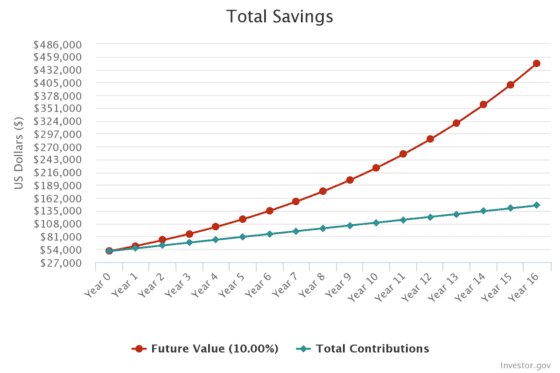

As an example, let's say you have $50,000 saved up that you can start a stock portfolio with.

If you can achieve a compound annual growth rate (CAGR) of 10% and add $500 to the investment each month, after 16 years the balance will have grown to $445,447.

So if you are 30 years old now, that's retirement at 46.

Does that sound good?

I wish you the best for your investments.