S&P/ASX 200 Index (ASX: XJO) healthcare stock Sonic Healthcare Ltd (ASX: SHL) is taking a tumble today.

Shares in the global pathology provider closed yesterday trading for $30.50. At the time of writing on Thursday, shares are swapping hands for $29.09 apiece, down 4.6%.

That sees the healthcare share underperforming the ASX 200 today, with the benchmark index down 0.5% at this same time.

This comes following news of a United States-based medical acquisition.

What medical asset is the ASX 200 healthcare stock acquiring?

The Sonic Healthcare share price is dipping after the ASX 200 healthcare stock reported that it has signed binding agreements to acquire Pathology Watch.

Located in the US state of Utah, the medical technology business has developed and commercialised an integrated, end-to-end digital pathology platform for skin pathology.

Sonic will pay US$130 million (AU$200 million) for business, which it will fund from existing cash and debt facilities. Management said it does not consider the transaction to be material for Sonic Healthcare.

Management noted that Pathology Watch is currently at pre-profit stage. However, they expect to "achieve attractive earnings per share and return on invested capital accretion" over the coming years.

The ASX 200 healthcare stock said the opportunities include accelerating Sonic's transition to digital pathology; providing a competitive advantage in existing dermatopathology markets; and promoting "significant synergies" with its AI partner, Franklin.ai.

Commenting on the acquisition, Sonic CEO Colin Goldschmidt said:

The acquisition of Pathology Watch is an important and enormously exciting step in Sonic's transition to digital pathology and pathology AI and offers multiple avenues for value creation.

He added that the next steps are to work with Pathology Watch to "enhance our digital pathology and AI strategy, and to provide competitive advantage for Sonic through a superior service offering to referring physicians and their patients".

The founders, management team and staff of Pathology Watch are expected to stay on with the business.

The acquisition remains subject to customary conditions. Sonic expects to close the transaction in December.

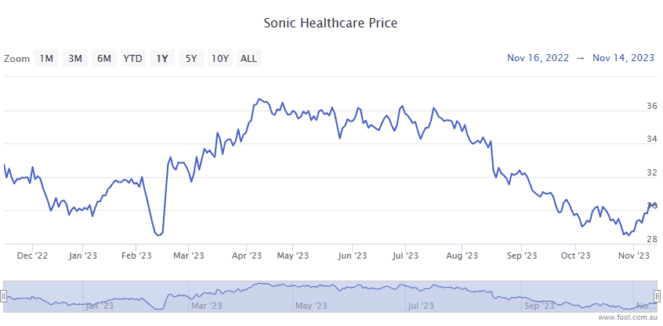

Sonic Healthcare share price snapshot

Today's fall has pushed the ASX 200 healthcare stock back into the red for 2023.

Since the opening bell on 3 January, the Sonic Healthcare share price is now down 1%.