The Flight Centre Travel Group Ltd (ASX: FLT) share price is cruising lower today following the company's annual general meeting (AGM).

At the time of writing, shares in the travel agency are down 2.4% to $18.98. In contrast, the S&P/ASX 200 Index (ASX: XJO) is blasting upwards in morning trade — gaining 1.5% as investors react to a subdued 3.2% inflation print in the United States overnight.

Oddly enough, the broad-based buying across the Australian market has left Flight Centre shares on the sidelines. The disinterest coincides with a relatively positive set of first-quarter figures revealed at this morning's AGM.

How is the company travelling in FY24?

In today's AGM address, management provided some insight into how Flight Centre has fared in its first quarter of FY2024.

The total transaction volume (TTV) achieved by the travel agent in Q1 marked the second-strongest start to a year in its history, clipping the ticket on $6 billion worth of TTV — increasing 20% year-on-year. Flight Centre's TTV is now just shy of the $6.2 billion achieved before the pandemic.

Notably, the company's corporate total transaction volume maintained 'record levels', reportedly outpacing the broader industry's recovery.

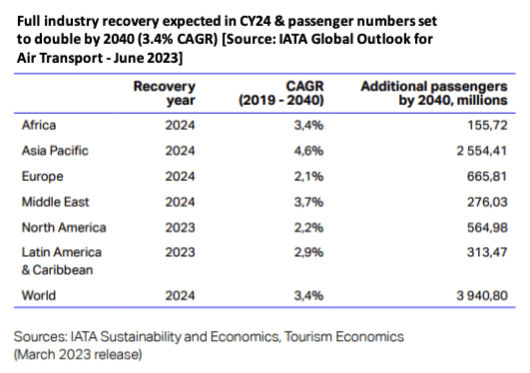

In the wake of the pandemic, much of the travel sector remains in a state of recuperation. However, a Flight Centre managing director highlighted data from the International Air Transport Association (pictured above) to illustrate the industry outlook.

With most markets expected to recover next year, the director stated:

While there will inevitably be short-term, cyclical challenges to overcome, the industry outlook is bright with IATA projecting 3.4% compound annual passenger growth globally through to 2040.

The travel agent continues to regain its bottom line. In Q1 FY24, Flight Centre boosted its underlying profits before tax by 500% to $54 million at a margin of under 1%. Meanwhile, earnings before interest, taxes, depreciation, and amortisation (EBITDA) increased threefold to $102.3 million.

What's expected?

The past is the past, and shareholders want to know what's ahead. Fortunately, management provided a glimpse into the rest of the financial year.

Flight Centre expects to deliver underlying profit before tax between $270 million and $310 million in FY24. This would represent a ~175% increase on the prior financial year if the midpoint of $290 million is achieved.

Furthermore, management has pencilled in underlying EBITDA of between $460 million and $500 million — indicating 60% growth at the midpoint.

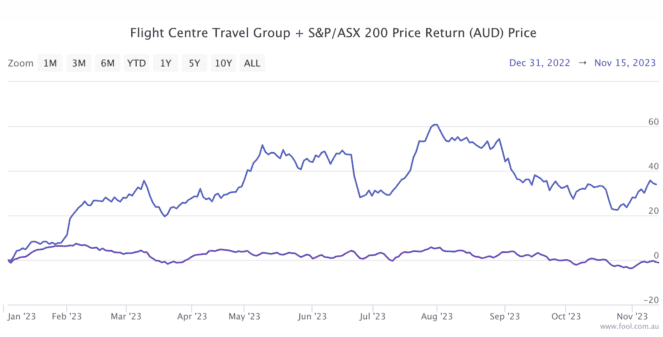

Where has the Flight Centre share price flown in 2023?

Rising rates and global uncertainty have dragged the Australian share market this year. Within the first month of trading, the ASX 200 index had rallied more than 8%. However, the road has been a bumpy one since then.

For the Flight Centre share price, it's been a different story.

At first, the travel agent moved in unison with the broader index, gaining ~8% in January. Although, the two parted ways from there. The general trend has mostly been upward for Flight Centre shares this year.

The company's shares peaked at $23.37 on 31 July before retracing its steps to its current $18.92 price point. Nevertheless, Flight Centre shares have drastically outperformed the Aussie share market with its 31.4% gain so far this year.