ASX dividend share Dexus (ASX: DXS) has seen significant pain in the last few months amid the higher interest rate environment.

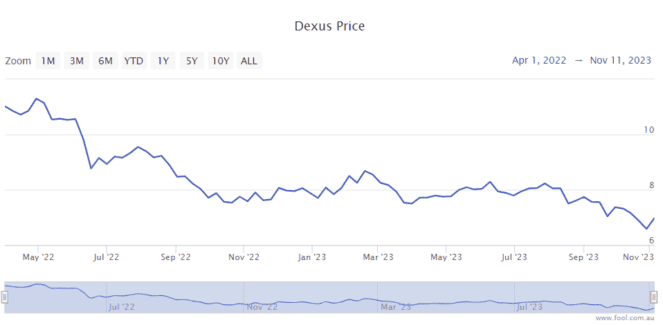

The Dexus share price has fallen around 20% from February 2023 and 37% from April 2022, as we can see on the chart below.

What's Dexus?

Dexus describes itself as a 'real asset' group that manages Australian real estate and infrastructure, currently valued at $61 billion following the acquisition of AMP Limited's (ASX: AMP) Capital segment.

It directly and indirectly owns $17.4 billion of office, industrial, healthcare, retail, and infrastructure assets and investments. It manages a further $43.6 billion of investments in its funds management business which provides third-party capital with exposure to "quality sector-specific and diversified real asset products".

Dexus also says it has a $17.4 billion real estate development pipeline which provides the opportunity to grow its portfolios.

Office holdings represent $24 billion of the overall portfolio, industrial represents $12 billion, retail is $10 billion, healthcare is $2 billion, and infrastructure is $11 billion.

Forecast for the ASX dividend share

The recent fall of the Dexus share price over the past two years has pushed up the company's projected distribution yield.

According to projections on Commsec, the company is estimated to pay a distribution of 48 cents per security in FY24 and 49 cents per security in FY25. That would translate into forward distribution yields of 6.8% and 6.9% in FY25.

That's not the biggest yield from a property business on the ASX, but it's a lot higher than it was in 2022.

Time to buy?

Dexus believes population growth will support continued urbanisation, with an approximate 50% rise in the Australian population to 40.5 million people by 2063.

There are a few different areas the ASX dividend share's infrastructure business can focus on, including transport, such as airports, and the energy sector where it can invest in utilities (including transmission) and renewable energy generation.

It has useful tailwinds in the coming years which can enable rental growth and unlock the potential for more projects in cities across Australia.

The company has a large development pipeline, which can unlock more rental earnings. However, the yield on cost of some of these developments doesn't look as attractive in this new high interest rate environment.

For example, the Atlassian Central building, currently being built in Sydney, has a projected cost estimate of $1.45 billion but the expected (rental) yield on cost is only between 4% to 5%. Dexus is expected to own at least 60% of this building on completion. That's not a great yield considering where bond yields are now.

I think it could be a long-term buy today, but it's possible the higher interest rate environment could open up a better buy price in the next 12 months.