ASX dividend shares can be a great source of passive income because dividends will keep flowing in without us having to work for them.

Want to know more? The two stocks I'm going to talk about in this article both have projected dividend yields of more than 7%.

Although we can get much better interest rates for our savings accounts these days, the yields from the companies I'm going to talk about are even more exciting.

Share price volatility is normal. However, these companies can pay us to hold and wait for better economic conditions for share price growth in the longer term.

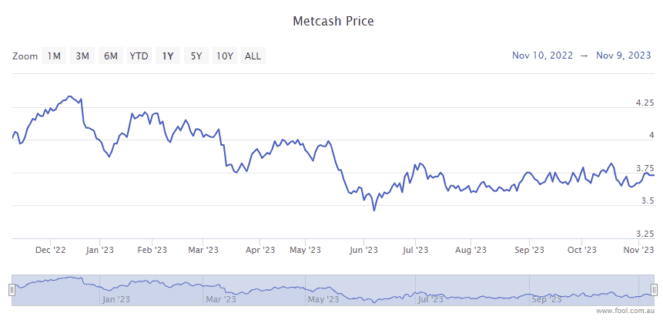

Metcash Ltd (ASX: MTS)

Metcash supplies a number of independent businesses, including IGA supermarkets around the country. It also supplies liquor stores such as IGA Liquor, Bottle-O, Cellarbrations, Porters Liquor, Thirsty Camel, Big Bargain Bottleshop and Duncans.

Another big part of the ASX dividend share is its hardware segment – it owns the brands Mitre 10, Home Timber & Hardware and Total Tools. It also supports independent operators under the small format convenience banners Thrifty-Link Hardware and True Value Hardware, plus a number of unbannered independent operators.

I think Metcash's earnings are largely defensive in that people still need to keep eating even in tough economic times. I think consumers of liquor will keep buying, and hardware stores will continue to see demand. Australia's rapidly growing population should be a longer-term tailwind as well.

Metcash has committed to a dividend payout ratio of 70% of underlying net profit after tax (NPAT), which is a generous amount and could see pleasing dividend income continue.

Its FY23 grossed-up dividend yield is 8.6%, and the forecast on Commsec suggests it could pay a grossed-up dividend yield of 8.2%.

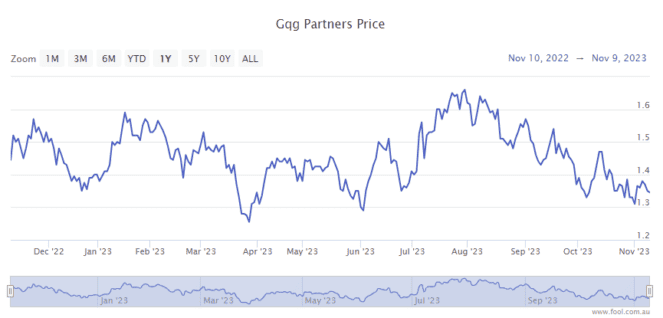

GQG Partners Inc (ASX: GQG)

GQG is a fund manager headquartered in the United States, which is a huge market.

The ASX dividend share is looking to grow its funds under management (FUM) over time through organic net inflows, launching new funds and expanding geographically.

This company looks to pay out 90% of its distributable earnings. Ongoing net inflows and investment performance are useful tailwinds for FUM. A large majority of the revenue and earnings come from management fees rather than performance fees, so its long-term FUM growth is very useful.

The fund manager says:

Our goal is quite simple: to compound our clients' capital over time. To do this, we need to protect assets in difficult markets and participate in rising markets. We have developed an investment approach that strives to do just that, based on a lens we call forward looking quality.

This concept ignores the traditional investment constraints associated with growth and value and instead focuses on investing in companies that we believe are going to be successful over the next five years and beyond.

Using the estimate on Commsec, the business is projected to pay an annual dividend per share in 2024 of 15.1 cents, which is a forward dividend yield of 11.5%.