The Fortescue Metals Group Ltd (ASX: FMG) share price has been rising over the past month, it's up by 12%. Can the miner continue this run?

It's notoriously difficult to forecast what is going to happen with ASX mining shares – the share price of any business can move up and down in the shorter term, and commodity price changes are an added complication.

Mining businesses are able to leverage higher commodity prices to generate stronger profits because mining costs don't change much from month to month. Extra revenue for that production is mostly extra profit, which can then help the Fortescue share price.

Profitability is rising

The key commodity for Fortescue is the iron ore price. A few months ago, in August the iron ore price was close to US$100 per tonne. Since then, it has recovered to US$128 per tonne, according to Trading Economics.

Why has the iron ore price been rising? Trading Economics suggests that the price is climbing because economic stimulus from the Chinese government will add to the demand for resources, particularly iron ore. China is planning to issue an extra CNY 1 trillion in debt, which is aimed to help areas like infrastructure and manufacturing projects.

This help from the Chinese government can offset the lower demand for residential construction which is going through some difficulties amid high debt levels.

Trading Economics noted that a Chinese business called Boashan Iron and Steel said that traditional and new infrastructure sectors in China will "support steel demand in the near-term."

As the iron ore price rises, it increases Fortesue's monthly profitability, particularly with the high-grade iron project Iron Bridge now operational.

Can the Fortescue share price keep rising?

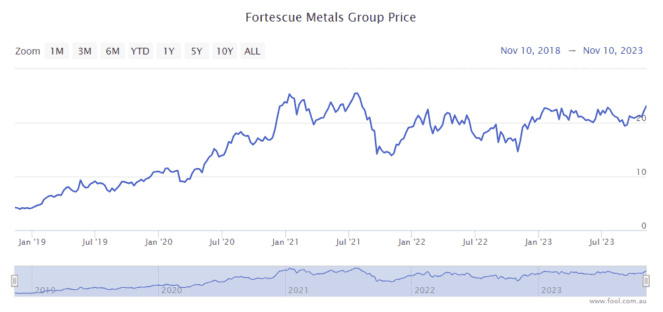

The rising iron ore price certainly helps investor confidence. But if we look at the Fortescue share price over the past five years, it has only briefly gone above $25 a couple of times when the iron ore price was much higher than today.

Share prices are meant to be forward-looking, so investors have supposedly already taken the iron ore rally into account with the current Fortescue share price valuation.

It's important to remain focused on the long-term when it comes to investing in companies, and not to focus on where a share price might go in a month or two. We can give ourselves a better chance of being right if we focus on longer-term timeframes.

Broker targets, which is where they think the share price will be in 12 months, certainly don't suggest confidence the Fortescue share price rally will continue.

Goldman Sachs currently has a sell rating on the ASX mining share, with a price target of $16.30. UBS is currently neutral on Fortescue, with a price target of $20.30. In other words, they both think it's headed lower, not higher, from here.

I don't know what's going to happen, but it could take a Christmas miracle for Fortescue to rise to $25 in such a short space of time. Positive surprises with the green hydrogen projects could be a useful catalyst, but investors are likely already aware of the company's shorter-term efforts in this area.