Owners of Rio Tinto Ltd (ASX: RIO) shares usually get a good dividend each year. Still, a high dividend yield isn't everything, so is this a good time to invest in the big miner?

A dividend yield is dictated by what multiple of earnings the company trades at – its price/earnings (P/E) ratio – and how much of its profit the company pays out in dividends – the dividend payout ratio.

Assuming the commodity price stays at a decent level, ASX iron ore shares like Rio Tinto and BHP Group Ltd (ASX: BHP) should be able to pay good dividends because they trade on fairly low P/E ratios and have quite generous dividend policies.

How big will the Rio Tinto dividend yield be?

According to Commsec, Rio Tinto is projected to pay an annual dividend per share of $6.73 in 2024 and $6.56 per share in 2025.

At the current Rio Tinto share price, that implies the ASX mining share could pay a cash yield of 5.6% and 8% grossed-up in 2024.

For 2025, the cash yield is only slightly lower — 5.5% and a grossed-up dividend yield of 7.8%.

The company is currently making good monthly profit because the iron ore price is sitting at a healthy level. According to Trading Economics, iron ore is currently going for US$126 per tonne on the back of "renewed hopes that economic stimulus from the Chinese government will create added demand for resources".

The Asian superpower revealed it will accelerate the issue of sovereign bonds after widening its budget deficit to accommodate an additional CNY 1 trillion of debt. The Chinese government is particularly targeting steel-focused infrastructure and manufacturing projects.

Is this a good time to invest in the ASX dividend share?

When a company is doing well, it's no surprise more investors are attracted to it.

However, I think investors need to take a contrarian approach when it comes to Rio Tinto shares — and many other ASX mining shares — because of their cyclical nature.

I believe it makes the most sense to invest in a miner when the relevant commodity price has sunk and the share price is down.

Over the longer term, I think the best time to invest in Rio Tinto shares is when the iron ore price has fallen below US$100 per tonne.

In the interim, I expect Rio Tinto will keep paying dividends, and I like its growing exposure to copper. But I believe there will be a better price to invest.

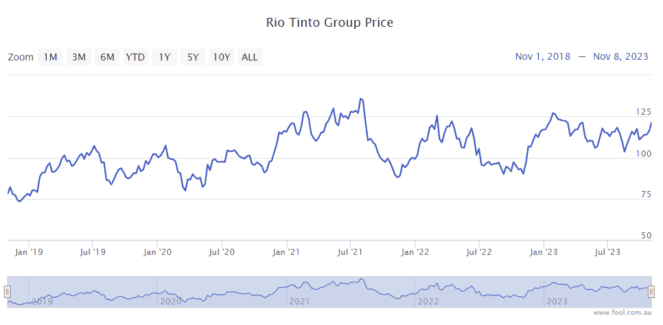

Just look at the Rio Tinto share price chart below for the last five years. Now is a relatively expensive time to buy although, of course, it's impossible to say when the next sizeable decline will be.