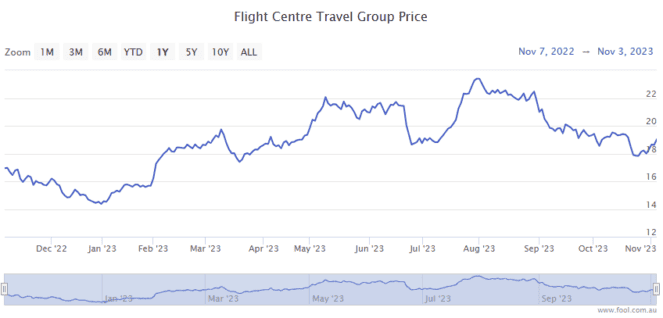

After dropping 3.9% in October, Flight Centre Travel Group Ltd (ASX: FLT) shares are off to a promising start in November.

The S&P/ASX 200 Index (ASX: XJO) travel stock closed out October trading for $18.63 a share. With the stock up 0.3% in afternoon trade on Monday to $19.13, that puts the stock up 2.7% on this fourth trading day of November.

For some context, the ASX 200 is up 3.3% over this same period.

So, what's next for Flight Centre shares?

Will November prove painful for short sellers in Flight Centre shares

Despite a solid start to the new month, Flight Centre shares remain amongst the top 10 most shorted on the ASX.

The travel stock had 9.55% of its shares held short as at market open today. Traders may be betting the stock will retrace as consumers tighten their belts and potentially cut back on travel spending.

Traders might also be shorting the stock over potential concerns around revenue margin headwinds.

At its FY 2023 results, released on 30 August, Flight Centre reported that it expects revenue margin "to remain below historic levels, predominantly as a result of planned and ongoing business mix changes brought about by rapid growth in lower revenue and lower cost margin businesses and sectors".

Still, there was plenty to like about the bulk of the company's full-year metrics.

Bullish highlights for Flight Centre shares included a 112% year on year increase in total transaction value (TTV) to $21.94 billion. And revenue soared 127% from FY 2022 to reach $2.28 billion.

You also may have noticed that Flight Centre shares delivered their first dividend since 2019, after which COVID all but shuttered its business model. The renewed fully franked dividend of 18 cents per share hit eligible investors' bank accounts on 19 October.

Flight Centre also retains a strong balance sheet heading into November, with a cash balance of $1.28 billion as at 30 June.

While I won't speculate on specific moves for Flight Centre stock in November, Morgans has a positive outlook for the ASX 200 travel stock.

In October the broker noted:

With confidence that the travel recovery has much further to go and the benefits of FLT's transformed business model emerging, we think the company is well placed over coming years.

Morgans has an add rating on Flight Centre shares with a $26 price target. That represents a potential 36% upside from current levels.