I love finding S&P/ASX 300 Index (ASX: XKO) share opportunities. I write about them a lot so I thought I'd actually try to take advantage of the good prices I'm seeing. One of my latest buys was Temple & Webster Group Ltd (ASX: TPW).

This business sells a wide array of homewares and furniture, with a large amount of the products sent directly to customers from suppliers, making it a capital-light business and reducing the level of inventory that the company needs to hold.

Here are the three main reasons why I invested.

Lower price

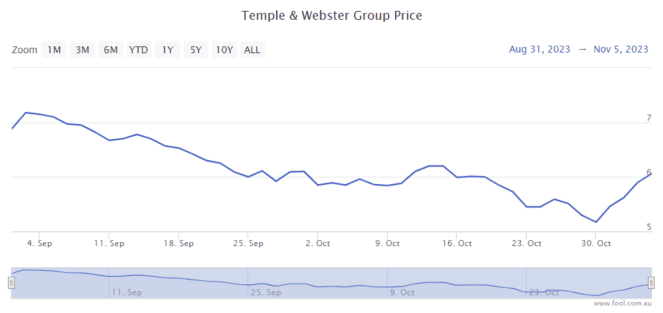

I was able to invest $3,000 at a Temple & Webster share price of $5.41 each. That represented a decline of around 25% from the price where it was trading at the end of August, as we can see on the chart below. It was also down by around 60% from October 2021.

A lower price doesn't necessarily mean that success is guaranteed, but buying with a larger margin of safety is helpful.

I wasn't thinking that the ASX 300 share would be at this low price forever. At the moment there's plenty of uncertainty because of the high cost of living for households. But, I don't believe these negative conditions will persist forever.

In my opinion, the company has a very promising outlook, so the lower price made the business look attractive to me.

Impressive revenue performance

I've been impressed by how the business has managed to keep doing well despite the tricky trading conditions.

In FY24 to 13 August, revenue had increased 16% compared to the prior corresponding period thanks to growth in both repeat and first-time customers.

In FY23, it achieved $396 million in revenue. The company wants to reach annual sales of at least $1 billion within three to five years.

That revenue growth includes a number of initiatives, such as becoming the top-of-mind brand in its furniture and homewares category, generating the majority of revenue from exclusive products, developing "market-leading capabilities around technology, AI and data", lowering its fixed costs as a percentage of revenue to obtain a price and margin advantage, and building scale through adjacent growth plays, including home improvement and trade and commercial.

As revenue keeps growing, the business is expecting to achieve scale benefits. I think it can keep growing, even if it just benefits from Australia's growing population and growing adoption of shopping online.

Stronger profit margins in the future

Investors often like to value an ASX 300 share based on its profitability.

The company notes that because it doesn't have physical store costs, its fixed cost base will "naturally be leveraged across greater scale, significantly reduced costs" as revenue increases.

It can benefit from AI that can only be provided by an online business such as customer care, operations and so on. In FY23, it lowered its customer care and operations overhead costs from 3% of sales (in FY22) to 2.5% of sales (in FY23).

In FY23, it achieved a business-as-usual (BAU) earnings before interest, tax, depreciation and amortisation (EBITDA) margin of 3.7%. In the long term, it's aiming for a BAU EBITDA margin of at least 15%.

Scale benefits are expected to help with suppliers, private label and made-to-order share increases, improved logistical efficiencies and AI efficiencies.

As the number of repeat customers and repeat revenue increases as a percentage of the total, this will help the market cost run at a lower level compared to revenue.

If revenue and profit margins keep increasing, then this business could have a really good future.