Looking at the performance of ASX shares over the past two months, it would appear the local bourse has jumped on the Black Friday bandwagon… with some early blockbuster deals!

Since the end of August, the S&P/ASX 200 Index (ASX: XJO) has fallen a painful 7.3%. But over the same period, many quality companies have had their share prices slashed by considerably more.

Given how much our Foolish contributors love a bargain buy, we asked them which ASX shares they think are worth adding to your investment shopping list this month.

Here is what the team came up with:

5 best ASX shares for November 2023 (smallest to largest)

- DroneShield Ltd (ASX: DRO), $158.98 million

- Temple & Webster Group Ltd (ASX: TPW), $672.53 million

- Jumbo Interactive Ltd (ASX: JIN), $862.98 million

- Treasury Wine Estates Ltd (ASX: TWE), $8.73 billion

- Washington H. Soul Pattinson and Co. Ltd (ASX: SOL), $12.16 billion

(Market capitalisations as of market close 31 October 2023).

Why our Foolish writers love these ASX stocks

DroneShield Ltd

What it does: DroneShield develops and sells artificial-intelligence-powered hardware and software to detect and disable drones. The company's clients include governments and militaries, airports, commercial venues, prisons, and critical infrastructure around the world.

By Bernd Struben: Unfortunately, we live in a world of ongoing global and regional tensions. And technology, like drones, is playing an increasing role in these tensions.

Enter DroneShield: A company I believe is well situated to help protect its global clients against the increasing use of – and threats posed by – autonomous systems.

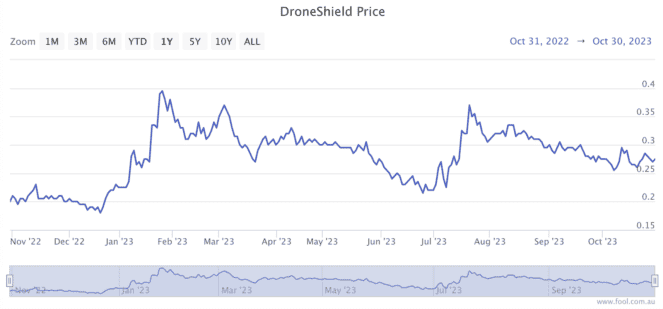

The DroneShield share price is up 35% in a year, but I think there's more growth to come.

The company reported $48 million in year-to-date cash receipts and grants as at Friday 20 October, three times its earnings for the entire 2022 fiscal year. And it reported a $51 million contracted order backlog, with more than $400 million in its sales pipeline.

Furthermore, I believe a 13% pullback over the last six months makes the DroneShield share price an attractive buy right now.

Motley Fool contributor Bernd Struben does not own shares of Droneshield Ltd.

Temple & Webster Group Ltd

What it does: Temple & Webster is an Australian online retailer of homewares and furniture. Claiming to be the leader in its category, the company features over 200,000 products for sale on its website from hundreds of suppliers.

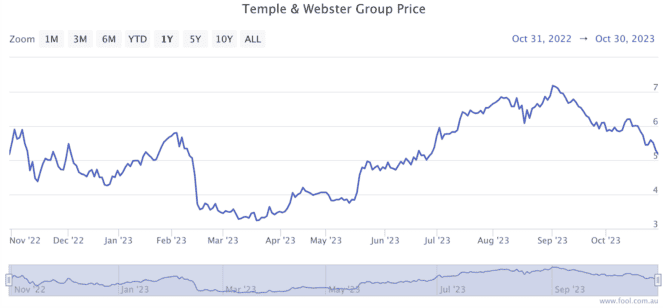

By Tristan Harrison: I very recently took the opportunity to invest in this ASX retail share after it fell 25% from 31 August 2023.

Despite all the wider economic concerns, this business grew revenue by 16% in the first few weeks of FY24, which I believe bodes well for longer-term growth.

I think Temple & Webster can benefit from the continued uptake of online shopping, with more people shopping online more often (and increasing their spending). The company's revenue per customer continues to rise steadily, with revenue per active customer increasing by 6% in FY23.

I believe profit margins can grow naturally over the longer term as the company scales up and its fixed costs become a smaller percentage of revenue. But, it's also deploying new technologies (such as AI) across the business in various ways to improve the customer experience and boost margins too.

Temple & Webster is also expanding in different categories, such as home improvement products (e.g. paint and flooring) and trade and commercial, growing its total addressable market.

Motley Fool contributor Tristan Harrison owns shares of Temple & Webster Group Ltd.

Jumbo Interactive Ltd

What it does: Jumbo Interactive is an online lottery company with operations across Australia, Canada, and the United Kingdom. A pioneer in internet-based lotto sales, Jumbo is now a go-to provider of digital lottery solutions for governments, corporations, and charities.

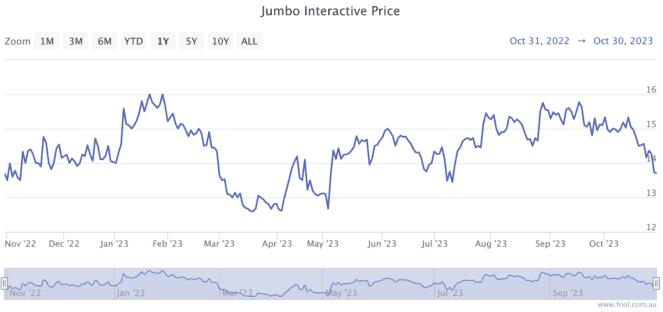

By Mitchell Lawler: Jumbo Interactive shares fell by around 11% in October. The retreat means the price per share is almost unchanged compared to where it was perched on 4 September 2020.

The market could be contemplating Jumbo's reliance on Lottery Corporation Ltd (ASX: TLC) for a substantial part of its business – the reselling of another company's tickets. An agreement exists until 2030 between the two, though what happens post-2030 could be creeping into investors' minds already.

While it is a real risk, I believe Jumbo Interactive shares present an attractive investment at the company's current valuation. Presently, the founder-led business trades on a forward price-to-earnings (P/E) ratio of less than 20.

Motley Fool contributor Mitchell Lawler owns shares of Jumbo Interactive Ltd.

Treasury Wine Estates Ltd

What it does: Treasury Wine is one of the world's largest wine companies and owns a collection of popular brands, including 19 Crimes, Penfolds, and Wolf Blass.

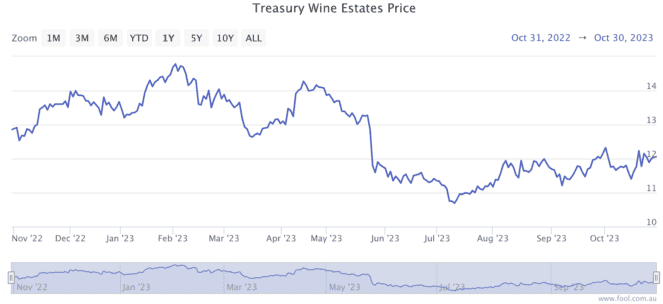

By James Mickleboro: I think now could be a great time to buy Treasury Wine shares with a long-term view. The company's shares are still trading at a deep discount to their 52-week high despite a recent recovery.

The last few years have been relatively tough for Treasury Wine after being effectively shut out of China. However, it now appears to be re-entering a growth phase after successfully redirecting the luxury wine that was earmarked for this market and yesterday announcing a major acquisition in the United States.

In addition, the Chinese government is reviewing its tariffs on Australian wine. If it removes these tariffs, this would likely give the company's growth a major boost in the coming years.

Goldman Sachs highlights that at its peak, Penfolds was shipping an estimated $400 million of stock to China. This compares to just $30 million in FY 2023. It is partly for this reason that the broker has a buy rating and a $13.40 price target on Treasury Wine shares.

Motley Fool contributor James Mickleboro owns shares of Treasury Wine Estates Ltd.

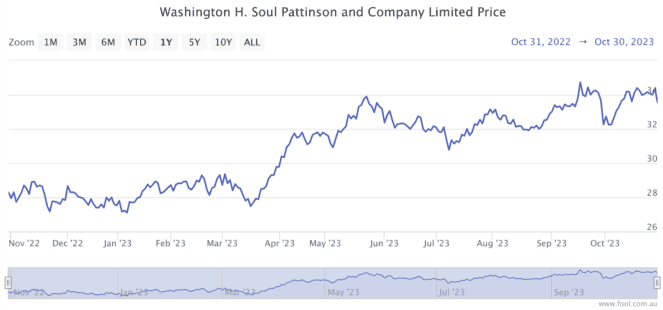

Washington H. Soul Pattinson and Co. Ltd

What it does: Soul Patts is an old ASX stock, having been around for more than a century. Today, the company manages a broad portfolio of different assets on behalf of its shareholders.

By Sebastian Bowen: Washington H. Soul Pattinson, or Soul Patts for short, is one of my favourite investments on the entire ASX. And that's why I think it's well worth keeping an eye on this November.

As we're all aware, the past few weeks have seen some significant falls on the markets. But this has meant some top-quality shares, including Soul Patts, are going on sale.

Soul Patts has an impressive, decades-long streak of delivering market-crushing returns through its diverse portfolio of investments. It also has a 23-year-and-counting streak of raising its annual dividend.

So, if this company continues to sell off in November, I think it could be a fantastic buying opportunity.

Motley Fool contributor Sebastian Bowen owns shares of Washington H. Soul Pattinson and Co. Ltd.